Hong Kong’s exchange operator is putting a spotlight on one of the murkiest corners of global finance: small-company stock venues.

By proposing sweeping changes to its Growth Enterprise Market on Friday, Hong Kong Exchanges & Clearing Ltd. made a rare acknowledgment that the small-cap market model used in financial centers from New York to London has failed to live up to its promise. While the venues are supposed to match investors with fast-growing businesses too tiny for major exchanges, the reality is that few of the companies make it big and most shareholders suffer losses.

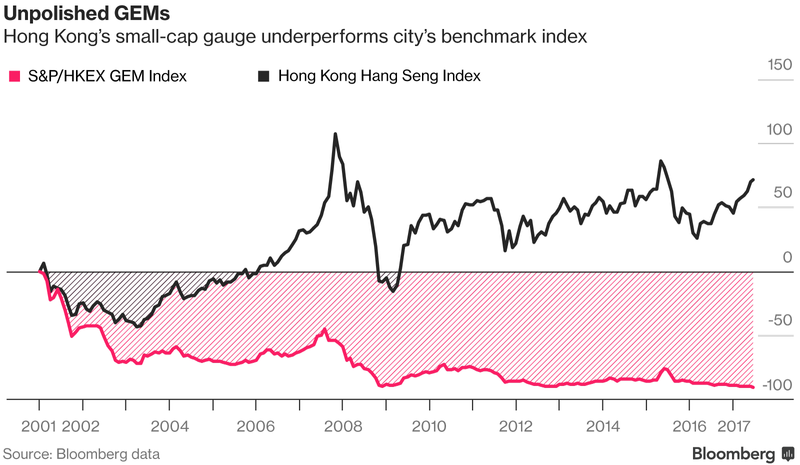

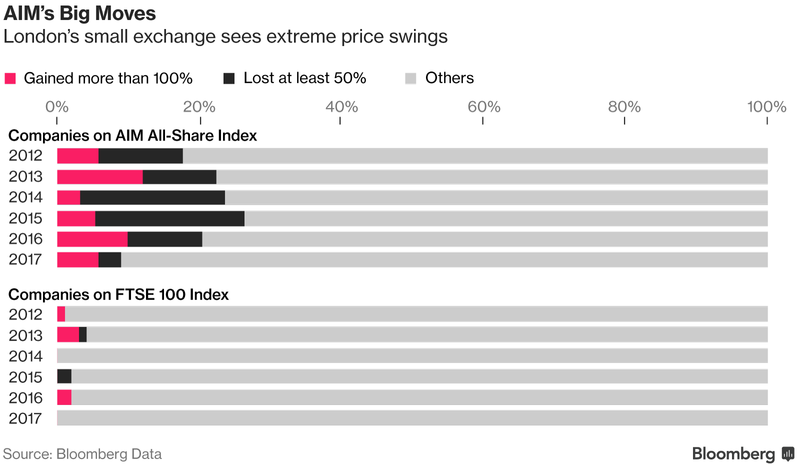

The numbers are sobering. On America’s over-the-counter stock market, one study shows investors lost 27 percent a year on average in the decade through 2010, versus an annualized return of about 1 percent for the S&P 500 Index. In Hong Kong, the benchmark GEM index has dropped 90 percent since its inception in 1999. On London’s AIM exchange, the majority of stocks lose money: greater than 70 percent had negative returns from the mid-1990s to mid-2015.

“It’s been in a terrible downward spiral,” Low Chee-keong, associate professor at the CUHK Business School and a former member of Hong Kong’s listing committee, said in a phone interview. The Hong Kong exchange “needed to find a way to address this.”

HKEX said its proposals, part of a wider effort to make the city’s markets more competitive, are meant to address concerns about the performance, volatility and liquidity of stocks on GEM. Venues in the U.K. and the U.S. have defended their existing rules, despite critics who say they’re too lax.

On London Stock Exchange Group Plc’s AIM market, there are no requirements for minimum size or trading history. Each listed firm selects and pays fees to its own primary regulator -- a brokerage known as a nominated adviser, or nomad. The system’s potential for conflicts of interest has attracted criticism, while some nomads have faced probes for their roles in market scandals.

“Exchanges do have some responsibility for investor protection,” said Paul Marsh, a professor at the London Business School. “While junior markets like AIM need to be lighter touch, I think the London Stock Exchange has, in a number of ways, been too laissez-faire.”

AIM is a “successful growth market” that’s enabled thousands of businesses to raise more than 100 billion pounds ($114 billion), a spokeswoman for LSE said. Rules for selling shares are “similar or in excess of requirements” for companies listing on other U.K. and international major exchanges, and the venue investigates breaches of its rules “vigorously,” she said.

On America’s Pink market, one of three over-the-counter platforms operated by OTC Markets Group Inc., there are no rules for financial standards or public disclosures. Though not regulated as stock exchanges, OTC venues are in many ways the U.S. equivalents of AIM and GEM.

The risks on such platforms came to the fore last August when the market value of Neuromama Ltd., an obscure search engine operator run by an ex-convict, more than quadrupled to $35 billion on tiny volume. The stock was temporarily halted by regulators because of potentially manipulative transactions and concerns about the “identity of the persons in control.” It has since been relegated to the so-called grey market, where companies often struggle to trade.