However, with the Russell 2000 having more than doubled since the March 2020 lows, we think it makes sense to be a bit cautious with small cap stocks in the near term. They are pricing in an optimistic recovery scenario when the ongoing threat of Covid-19 could delay the full reopening of the U.S. economy a little longer.

Also consider that a weaker U.S. dollar—which we expect in 2021—tends to help large cap multinationals more than smaller companies due to their higher international revenue exposure, which may limit the ability of small caps stocks to outperform.

Post-Election Surge

With much of the focus in 2020 on the performance of large cap growth and the “stay at home” trade, some investors may have overlooked the fact that the Russell 2000 actually outperformed the S&P 500 for the year, albeit slightly. Small caps were down year-to-date heading into the presidential election in November, but the policy clarity and prospects for more fiscal stimulus sparked a year-end rally of more than 22%, and pushed the Russell 2000 to its first all-time high since August 2018 [Figure 2].

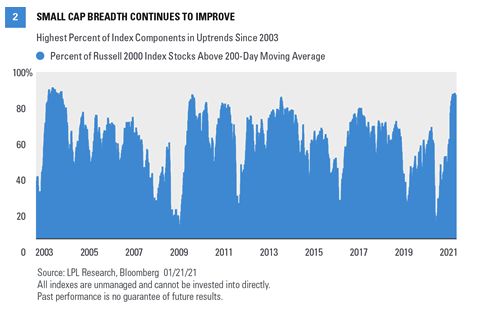

Performance has not be limited to the index level, either. Breadth continues to improve for small caps. (Breadth is the percentage of stocks in the category participating in the market.) The percent of index constituents trading above their 200-day moving average has surged to over 89%, the highest level since 2004. Not only is strong breadth a hallmark of a healthy market, but the levels of participation we are seeing now tend to be found almost exclusively at the beginning of bull markets, not the end.

The election outcome, stimulus prospects, and progress toward fully reopening the economy as Covid-19 vaccines are distributed have triggered a leadership change from large caps to small caps. However, it has not triggered the sort of style rotation we have seen within the large cap space. Even as large cap value has outperformed large cap growth by more than 5 percentage points over the past three months, small cap growth and small cap value performance have been equally stellar, with both the Russell 2000 Growth and Russell 2000 Value indexes returning 34%.

LPL Research’s View

At this point we are comfortable maintaining our neutral small cap view—but with a positive bias. We are in a favorable part of the economic cycle, the earnings outlook is quite strong, and small caps are enjoying strong breadth within the universe with most stocks exhibiting positive momentum. But much of the good news may be priced in already, introducing the potential for disappointment if Covid-19 delays the full reopening of the economy. Also, currency and tax headwinds may be on the horizon.

Thank you to LPL Research Senior Analyst Scott Brown, CMT for contributing to this commentary.

Jeff Buchbinder is an equity strategist for LPL Financial.