“Intuitively, if you believe in mean reversion, you should anticipate that at some point these are going to be lagging strategies,” Davidow says.

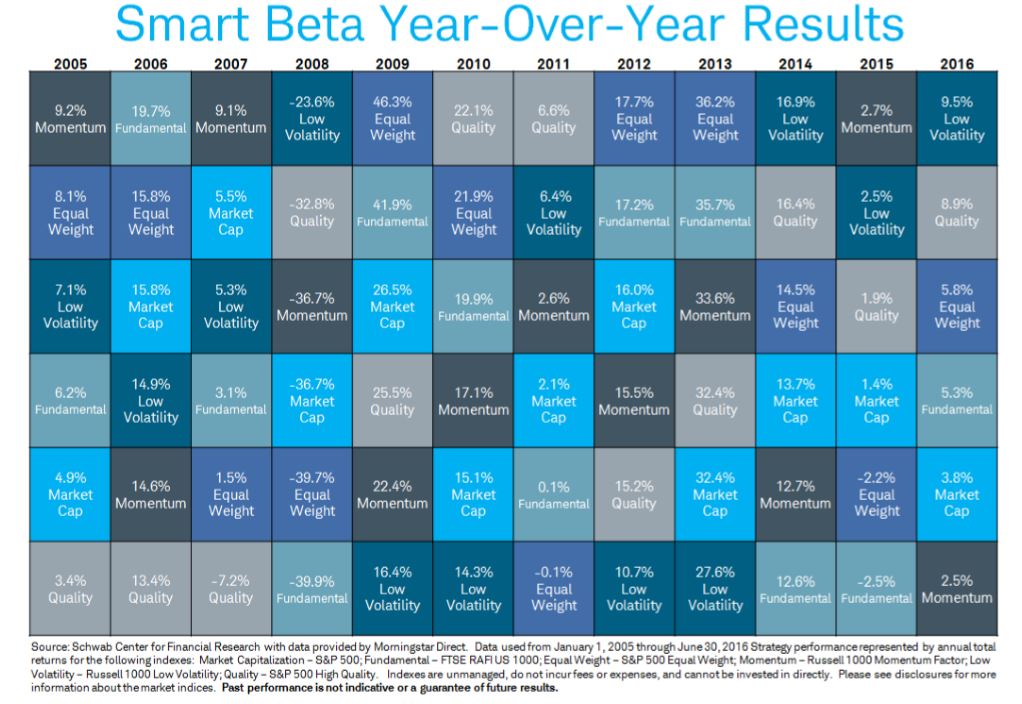

Low volatility, a recent high performer, was ironically among the most volatile factors by performance, offering the best returns in the analysis in 2008, 2014 and the first half of 2016, but the worst returns in 2009, 2010, 2012 and 2013.

Overall, the best smart beta performances were posted by the equal weighting strategy, which returned 46.3 percent in 2009 and 36.2 percent in 2013, both years where equities performed well in general.

The worst performances were posted by fundamental indexing in 2008, where it posted a -39.9 percent return amidst the global financial crisis, and by the quality factor, which posted a -7.2 percent return in 2007.

Also interesting is that on an annualized basis, a market capitalization-weighted index often ends up outperforming two or more smart beta strategies.

“All of these strategies claim to outperform their market-cap equivalents, and on a long enough timeline they do,” Davidow says. “When you compare them in a given year, however, they don’t necessarily deliver on that promise. It’s important for advisors and investors to keep that in mind.”