Uranium was among the best-performing assets in 2023, and for good reason. Uranium may likely be in a long-term supply deficit, with a cumulative undersupply of approximately 1.5 billion pounds expected through 2040.1 At the same time, Cameco, a leading producer of uranium, cut production estimates at its Cigar Lake and McArthur River/Key Lake sites2, reducing supply from an already uranium-starved market. A few other developments in December are adding more fuel to the fire for uranium and the energy transition.

Agreement On Nuclear Energy Reached At COP 28

In early December, the 2023 United Nations Climate Change Conference (COP 28) met in Dubai to discuss climate change. In a development that wouldn’t have been thought possible just a few short years ago, more than 20 nations launched the Declaration to Triple Nuclear Energy. As its name suggests, the Declaration, among other things, seeks to triple nuclear energy capacity by 2050. Endorsing countries include the United States, Canada, France, Japan and the United Kingdom.3 Noticeably absent was China, which is quickly moving to increase its nuclear energy capacity and already has 22 nuclear reactors under construction.4 In addition to working toward tripling nuclear capacity, participants of the pledge are committing to mobilizing investment in nuclear power, supporting the development and construction of nuclear reactors, and encouraging the World Bank to include nuclear energy in the organization’s energy lending policies.5

United States Moves To Ban Uranium Imports From Russia

On December 11, 2023, the U.S. House of Representatives passed a ban on imports of Russian uranium,6 and the bill is currently before the U.S. Senate, where it has bipartisan support. The Russian uranium ban would be phased in over a period of several years so as not to disrupt the flow of this critical mineral to United States utilities. According to the World Nuclear Association, Russia produces about 5% of the world’s uranium. In addition, increasing geopolitical tensions are of concern as Russia owns approximately 40% of the world’s uranium conversion and enrichment capacity,7 which are necessary steps in the uranium supply chain to get uranium from the ground to the reactor.

In a world where the mined supply of uranium meets only 74% of total uranium demand,8 removing Russian uranium has the potential to disrupt the market. While the House bill does contain waivers that would allow the import of low-enriched uranium from Russia if the U.S. energy secretary determines there is no alternative source available for the operation of a U.S. nuclear energy company or reactor or if the shipments are in the national interest,9 any disruption to the uranium supply chain may send prices considerably higher.

Renewable Energy Pledge May Offer More Investment Opportunities

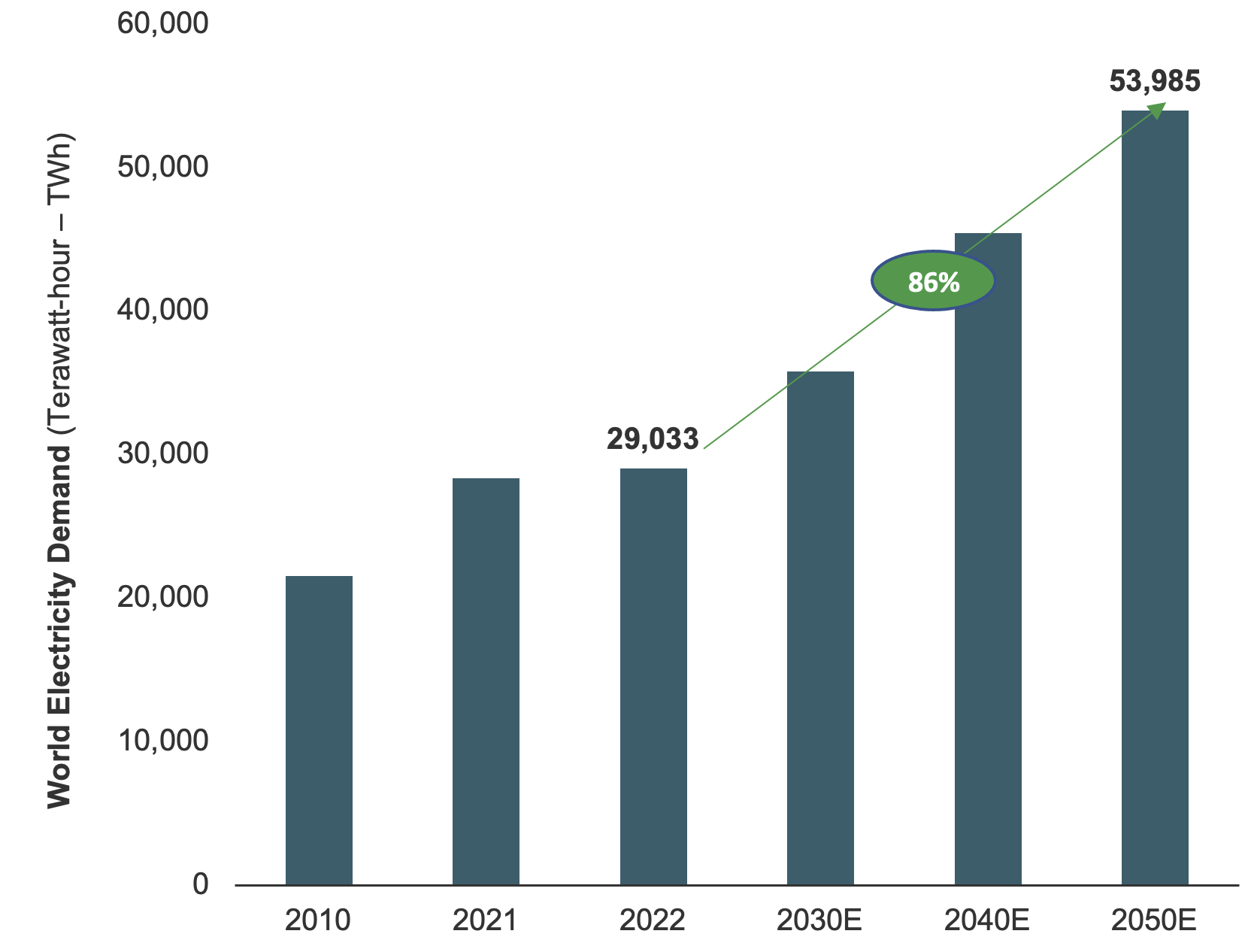

The nuclear energy pledge wasn’t the only agreement reached at COP 28. In one of the most widely supported initiatives, 118 governments pledged to triple the world’s renewable energy capacity by 2030.10 Decreasing reliance on fossil fuels is pivotal, as the world’s energy needs are expected to increase significantly through 2050. However, this massive commitment will require significant investment in energy infrastructure, technologies and significant supplies of new natural resources.

Figure 1: Electricity Demand Estimated to Increase by 86% by 205011

Miners May Be Poised For Growth

The energy transition is a resource-intensive endeavor requiring vast amounts of critical minerals, including uranium, copper, lithium, nickel, and rare earths, among others. Many of these minerals may likely be in structural supply deficits stretching through at least the end of the next decade. To meet expected future demand, we believe there will be continued investments in miners of critical minerals via direct partnerships or long-term offtake agreements from end users. Continued investment from governments through grants, subsidies, or tax credits, which have become commonplace in the electric vehicle market, may also be expected. Existing and developing miners of critical minerals may likely offer investment growth potential for the long term.

Steve Schoffstall is director of ETF product management at Sprott Asset Management.

1 Sources: UxC LLC. Data as of Q2 2023. World Nuclear Association as of 8/1/2023.

2 Source: Cameco, “Cameco Provides Production and Market Update,” September 3, 2023.

3 Source: U.S. Department of Energy, “At COP28, Countries Launch Declaration of Triple Nuclear Energy Capacity by

2050,” December 1, 2023.

4 Source: International Atomic Energy Association (IAEA) Power Reactor Information System (PRIS), December

2023.

5 Source: U.S. Department of Energy, “At COP28, Countries Launch Declaration of Triple Nuclear Energy Capacity by

2050,” December 1, 2023.

6 Source: Reuters, “US House Passes Bill Banning Uranium Imports from Russia,” December 11, 2023.

7 Source: CNBC, “Russia Dominates Nuclear Power Supply Chains—and the West Needs to Prepare Now to Be

Independent in the Future,” May 23, 2022.

8 Source: World Nuclear Association, August 2023.

9 Source: Reuters, “US House Passes Bill Banning Uranium Imports from Russia,” December 11, 2023.

10 Source: Reuters, “Countries Promise Clean Energy Boos at COP28 to Push Out Fossil Fuels,” December 2, 2023.

11 Source: IEA World Energy Outlook 2023 Stated Policies. Included for illustrative purposes only.

Important Information

This article is intended solely for the use of Sprott Asset Management USA Inc. for use with prospects, investors and interested parties. Investments, commentary and statements are unique and may not be reflective of investments and commentary in other strategies managed by Sprott Asset Management USA, Inc., Sprott Asset Management LP, Sprott Inc., or any other Sprott entity or affiliate. Opinions expressed in this presentation are those of the presenter and may vary widely from the opinions of other Sprott-affiliated Portfolio Managers or investment professionals.

The intended use of this material is for information purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice, since such advice always requires consideration of individual circumstances.

Generally, natural resources investments are more volatile on a daily basis and have higher headline risk than other sectors as they tend to be more sensitive to economic data, political and regulatory events as well as underlying commodity prices. Natural resource investments are influenced by the price of underlying commodities like oil, gas, metals, coal, etc.

The investments discussed herein are not insured by the FDIC or any other governmental agency, and are subject to risks, including a possible loss of the principal amount invested.

Past performance is not indicative of future results.

© Sprott 2024