Physical uranium was one of the best-performing assets in 2023, returning nearly 90%. The start to 2024 has been no different as uranium prices continue their rise, increasing another 16.5% to $106 per pound.1 Investors may wonder if there is still room to run in this uranium bull market. We believe so. Though the price of uranium has appreciated significantly, we’re still well shy of the record $140 per pound realized in 2007, or $200 per pound when adjusting for inflation. 2 In addition, global commitments to nuclear energy are on the rise.

Governments Are Increasingly Embracing Nuclear Energy

End-of-year news propelled uranium to fresh 16-year highs, which included an agreement reached at December’s COP28 meeting by 22 nations to triple their nuclear capacity by 2050. In early January, the UK government announced its intent to make faster investment decisions on new nuclear projects, on its way to quadrupling capacity by 2050.3 Achieving this goal would increase the share of Britain's forecasted electricity demand met by nuclear energy from 15% to 25%.4 All told, there are 170 nuclear reactors either under construction or planned for construction around the globe, representing an increase of about 35% in global nuclear reactors. 5

Uranium Miners Are Working To Meet Challenges

We’re coming out of a lost decade for uranium mining. The price of uranium dropped from about $140 a pound in 2007 to less than $20 per pound in 2016. This coincided with a prolonged period of underinvestment in the sector as mines were placed on care and maintenance. Utilities were able to use existing uranium stockpiles to meet energy generation needs as higher-cost mines went dormant. Those stockpiles have largely been depleted, and utilities find themselves needing to enter into offtake agreements to purchase future mine production years in advance.

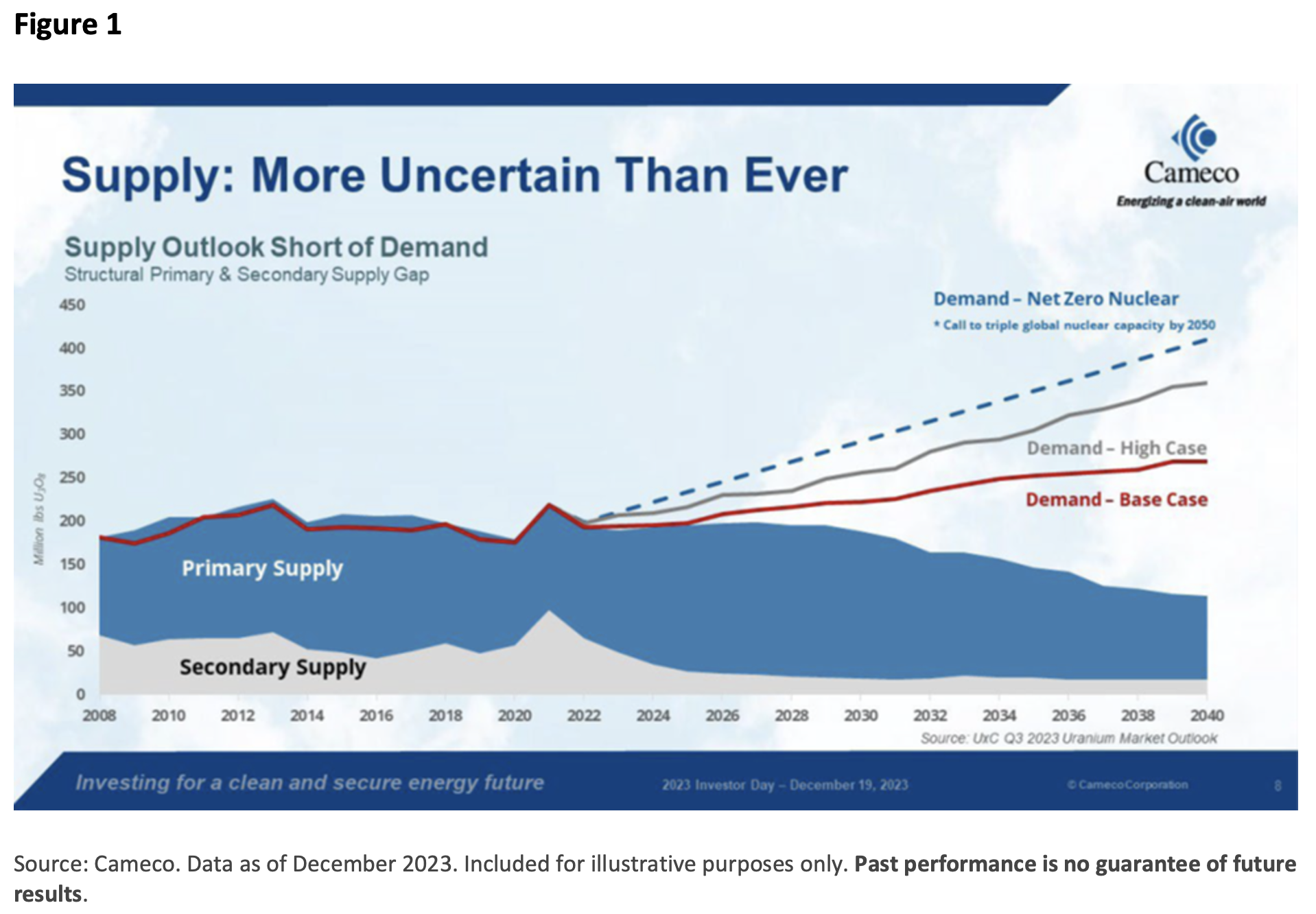

Now that uranium prices have returned to more profitable levels, many previously closed mines are taking steps to start producing again. However, adding to the supply of uranium isn’t as simple as flipping a switch, and increasing uranium production is proving to be difficult. Cameco, the largest uranium mining company by market cap, lowered its production forecast for its Cigar Lake Mine and its McArthur River/Key Lake operations, expecting a nearly 3-million-pound shortfall.6 Kazatomprom, which produces about 40% of the world’s uranium, warned that it may fall short of production targets over the next two years.7 The under-investment in the sector and long lead times to develop complex mines are clearly taking their toll and will slow the supply response. At its December Investor Day, Cameco released its uranium supply estimates through 2040. Figure 1 illustrates a potential shortfall of uranium to meet utility requirements, which may lead to a cumulative deficit of 2.3 billion pounds by 2040.

Is The Moment Yet To Come For Uranium Miners?

Though uranium miners have been one of the best-performing sectors of the equity market, their returns have collectively lagged physical uranium by considerable margins. To meet growing demand from utilities, uranium miners will require significant capital investments to increase supply.

We believe a growing uranium mining sector will attract additional and even larger investments drawn by the prospects of attractive investment returns. So, is there still room to run in this uranium bull market? We believe so, and uranium miners, with scarce representation in major market indexes, may add growth potential and diversification to investor portfolios.

Steve Schoffstall is director of ETF product management at Sprott Asset Management.

1 Source: Bloomberg as of January 19, 2024.

2 Source: TradeTech and Bloomberg as of December 31, 2023.

3 Source: Reuters, “UK to Invest Extra $1.7 Billion in Sizewell C Nuclear Power Station,” January 22, 2024.

4 Source: Reuters, “Britain Aims for Faster Investment Decisions on New Nuclear Projects,” January 11, 2024.

5 Source: World Nuclear Association as of August 31, 2023.

6 Source: Cameco, Press Release, September 3, 2023.

7 Source: Bloomberg, “World’s Biggest Uranium Miner Warns of Production Shortfall,” January 12, 2024.

Important InformationThis article is intended solely for the use of Sprott Asset Management USA Inc. for use with prospects, investors and interested parties. Investments, commentary and statements are unique and may not be reflective of investments and commentary in other strategies managed by Sprott Asset Management USA, Inc., Sprott Asset Management LP, Sprott Inc., or any other Sprott entity or affiliate. Opinions expressed in this presentation are those of the presenter and may vary widely from the opinions of other Sprott-affiliated Portfolio Managers or investment professionals.

The intended use of this material is for information purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice, since such advice always requires consideration of individual circumstances.

Generally, natural resources investments are more volatile on a daily basis and have higher headline risk than other sectors as they tend to be more sensitive to economic data, political and regulatory events as well as underlying commodity prices. Natural resource investments are influenced by the price of underlying commodities like oil, gas, metals, coal, etc.

The investments discussed herein are not insured by the FDIC or any other governmental agency, and are subject to risks, including a possible loss of the principal amount invested.

Past performance is not indicative of future results.

© Sprott 2024