Don’t be fooled by the recent rebound in stocks; the investment scene is beginning to resemble the 1929 market crash and the early 1930s Great Depression.

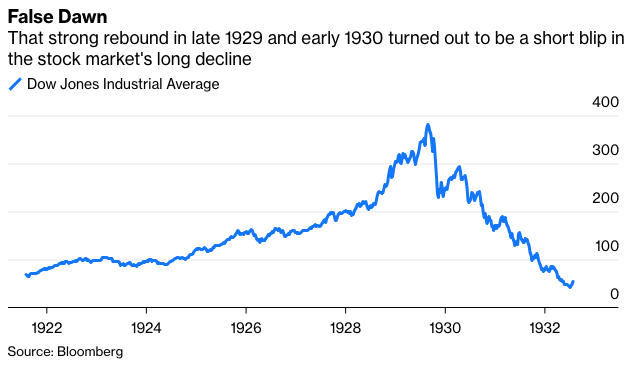

In the Roaring ‘20s, the Dow Jones Industrial Average jumped 500% from August 1921 to September 1929. It then plunged 48% from Sept. 3 to Nov. 13, 1929. To many, that seemed like a reasonable correction of the 1920s exuberance. The economy was fully employed and growing rapidly and most looked forward to more expansion and higher stock prices. Only days before the crash, prominent economist Irving Fisher stated that “stock prices have reached what looks like a permanently high plateau” and the market was “only shaking out of the lunatic fringe.”

Also, a 48% stock drop wasn’t exactly unique. The Dow fell 48.5% from Jan. 19, 1906 to Jan. 7, 1907 in conjunction with the Panic of 1907. Still, the economy didn’t collapse and stocks steadily recovered to close at the Dow’s old high by the end of 1909. If it hadn’t been for what followed, the 1929 Crash would probably have been recorded as just one more correction in the wild stock markets at that time. Despite the widespread interest in equities back then, only 10% of Americans owned equities in the 1920s, according to the Federal Deposit Insurance Corp.

So stocks rallied 48% until April 17, 1930, representing a 52% retracement. But as the Great Depression unfolded, stockholders bailed out or were sold out, and the Dow fell steadily until July 8, 1932, an 86% swoon and a drop of 89% from the September 1929 top.

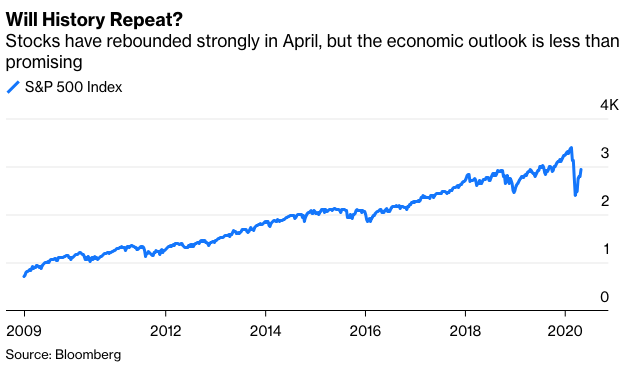

In parallel, the S&P 500 jumped 400% from March 9, 2009 to February 19, 2020. Then, fear of the coronavirus deflated that index by 34% through March 23. But, as investors anticipated control of the virus and the effects of massive monetary and fiscal stimulus, the S&P 500 jumped 32% through April 29, offsetting 53% of the earlier loss.

This looks like a bear market rally, similar to that in 1929-1930, with an additional 30% to 40% drop in stocks to come as the deep global recession stretches into 2021. In contrast, many look for a V-shaped economic rebound with a sharp recovery starting in the second half of 2020. A Bloomberg survey of economists foresees the economy contracting 3.7% this year before expanding 3.8% in 2021, far above the 2.3% growth rate in the previous expansion.

But bear markets that accompany recessions last about 11 months, far longer than the recent slump. According to Bank of America analysts, the U.S. stock market has never reached its bottom in less than six months after falling more than 30% in the face of a recession.

The gigantic monthly and fiscal stimulus employed so far, with more to come, are unlikely to offset the massive disruption of the coronavirus pandemic. Recall that the Federal Reserve’s decision to cut its benchmark interest rate to essentially zero coupled with the huge quantitative easing after the Great Recession did little to spur the economy, which grew at the slowest rate of any post-World War II expansion. Ditto for the gigantic 2009 tax cuts, rebates and massive federal sending that together amounted to 6% percent of gross domestic product.