Emerging markets’ wild ride

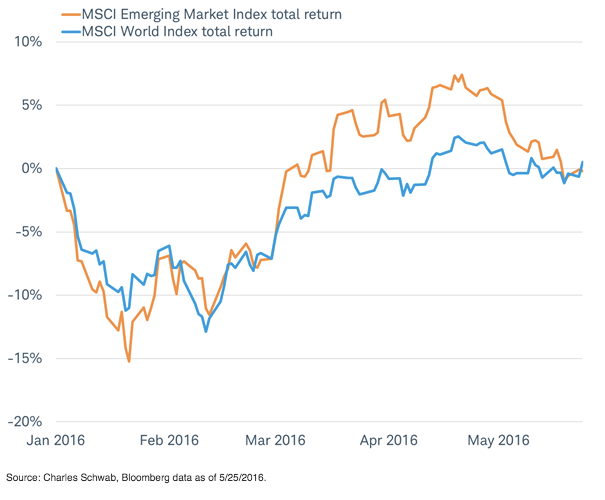

The changing view of the market about the Fed and the resultant moves in the U.S. dollar will likely continue to have an impact internationally as well. Emerging market (EM) stocks had been strong performers for much of this year after bottoming in January. The MSCI Emerging Market Index was up 6% for the year through the end of April. But, in May, the index has seen losses of 6%, and is now even for the year and slightly lagging the performance of developed market stocks, measured by the MSCI World Index, as you can see in the chart below.

MSCI EM performance YTD

The financial media has covered the fact that some well-known investment firms upgraded EM stocks to an overweight in the past couple of months. We did not and remain neutral on the asset class. While we believe EM stocks are an important part of a well-diversified portfolio and attractive for the long-term investor, in our 2016 Outlook we cautioned on EM stock market performance and noted that EM would likely be volatile and a laggard—that is so far proving to be the case. Here are three reasons why:

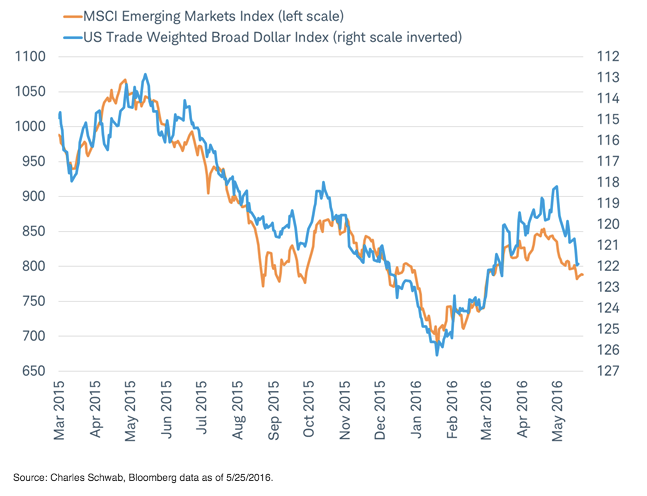

Emerging market performance has been U.S. dollar dependent, as you can see in the chart below. This is due in part to U.S. dollar-denominated debt owed by companies in EMs and also because the currency moves partly reflect capital flows in and out of EMs from the United States. We don’t see the renewed weakness in the U.S. dollar in the second half of the year that would help EM stocks outperform.

Emerging market stock performance has been linked to the dollar

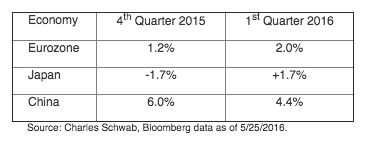

Gross domestic product (GDP) growth in developed markets like Europe and Japan this year has been surprisingly strong. For example, first quarter GDP accelerated from the fourth quarter and widely exceeded expectations with annualized growth of 2.0% in Europe and 1.7% in Japan. Yet, it appears policy makers are pulling back on economic stimulus in China which may weaken the outlook for EM economic growth.

GDP annualized

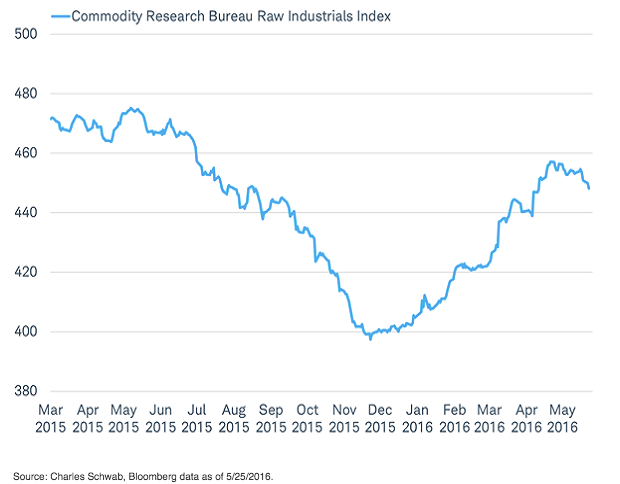

Industrial commodity prices may be due for a pause rather than continue to climb as they did earlier this year. Some EM countries rely on commodities for growth, such as Brazil.

Run up in commodity prices may have paused

EM stocks’ below-average valuations, structural economic reforms, and consumer-driven growth make EM stocks an attractive long-term asset class for portfolios, but they may lag developed markets in 2016. Our view continues to support a neutral allocation to EM stocks in 2016.

So what?

The running-to-stand-still pattern in U.S. equities may continue, with bouts volatility expected. But U.S. economic growth appears to be improving and stocks could start to sniff out a potentially better second half for both the economy and earnings. Investors should remain patient, and use volatility as opportunities to rebalance around normal strategic allocations in both U.S. and international equities.

Stocks Stuck In The Muck

May 31, 2016

Liz Ann Sonders is senior vice president and chief investment strategist at Charles Schwab & Co.

Brad Sorensen is managing director of market and sector analysis at the Schwab Center for Financial Research.

Jeffrey Kleintop is senior vice president and chief global investment strategist at Charles Schwab & Co.

« Previous Article

| Next Article »

Login in order to post a comment