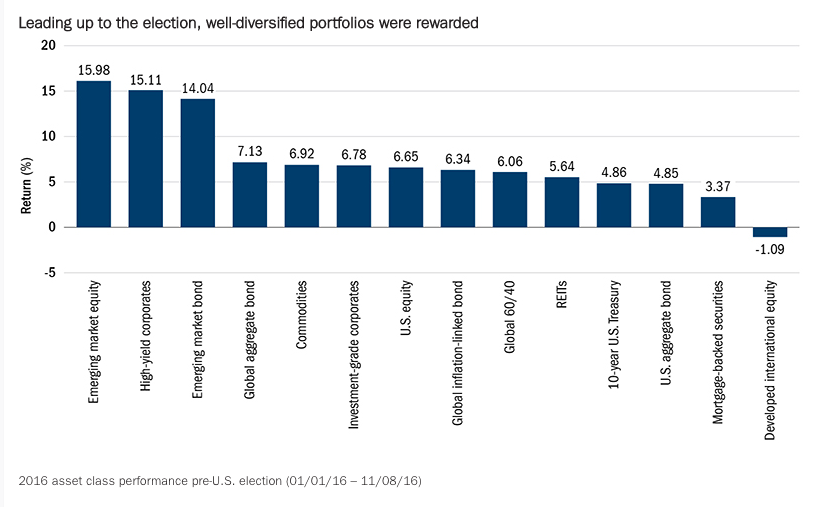

Leading up to the U.S. presidential election, we saw ample evidence making a case for diversification. Exposure to high-quality, interest-rate-sensitive bonds provided a powerful diversification benefit to offset losses in equities—especially during volatility episodes like the January selloff and the aftermath of the Brexit vote in June. Investors also benefited from a more global diversification strategy as emerging market stocks and bonds performed better than almost any other asset class. Finally, diversified investors saw returns from the near simultaneous rise across all classes, fueled in part by a continuation in accommodative central bank monetary policy.

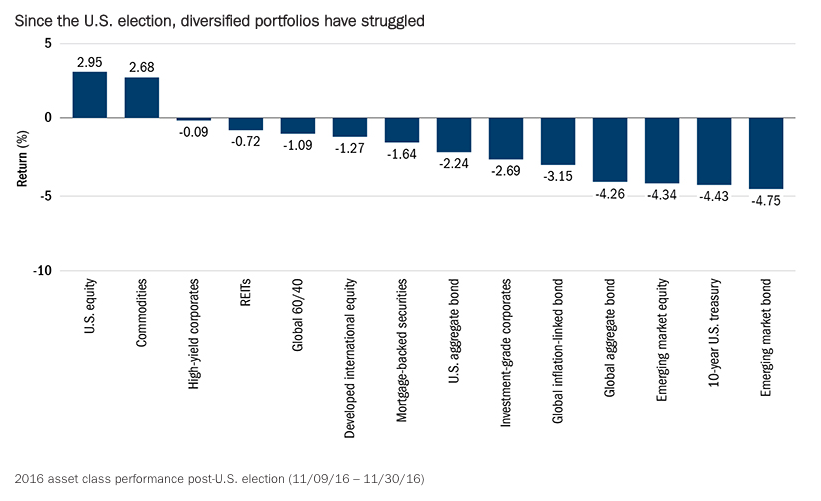

But since the U.S. election, diversified portfolios have struggled. Over this short period of time, markets have digested the implications of a more pro-economic growth, less onerous regulatory environment that could come from a Donald Trump administration and a Republican controlled House and Senate. After an initial selloff in the early morning hours after the election, U.S. equity markets have moved higher, hitting all-time highs on what seems like a daily basis. But as I’m sure you’re aware, other asset classes have not responded with similar enthusiasm.

International equity markets have lagged noticeably as a result of a strong U.S. dollar and potential isolationist trade policies from the new administration. Interest rates rapidly rose as bond markets priced in anticipation for stronger economic growth and higher inflation. What’s more, had it not been for OPEC’s announced production cuts at the end of November, which caused oil to spike higher in price, commodities would have also delivered a relatively lackluster performance.

The result is a performance pattern where U.S. equity markets have moved higher, but almost every other asset class has moved lower. So it’s understandable that diversified investors may have been frustrated, especially when reminded that “markets” (often narrowly defined as U.S. equity markets) continue to hit all-time highs, while portfolios struggle to keep pace. In fact, the more conservative the asset allocation strategy, the worse the outcome, because fixed-income assets have suffered the most following the election.

While diversification has struggled in recent months, it’s important to remember not to become disenchanted with what’s been a valuable strategy throughout market history. The range of possible outcomes under a Trump administration is very wide. The timing of implementing new policies is uncertain, and a likely reduction in accommodative monetary policy could prove troublesome to any suddenly emboldened equity investors. But although rising rates caused many fixed-income assets to experience one of their worst monthly returns on record, they likely improved forward-looking return expectations; there’s a high correlation with starting yields and future returns. You’ll be serving your clients well by retaining their exposure to numerous asset classes. We expect that the benefits of diversified investing will re-emerge in short order.

As U.S. Equities Move Higher, Other Asset Classes Retreat

Bottom Line