They now make up 20% of U.S. equity trades, double the total last year, according to internal estimates at Citadel Securities, the U.S.’s biggest market maker. That share approaches 25% on peak days, says Joe Mecane, it’s head of execution services.”

By December 2020, the stock market had come back from a March 2020 collapse to experience significant gains. According to Patti Domm, writing for CNBC: “JMP estimates the brokerage industry added more than 10 million new accounts in 2020, with Robinhood alone likely representing about six million.”

And in 2021 the GameStop (GME) short squeeze has begun to percolate questions around the relationship between retail investors and their brokers.

Retail Moving Forward

Retail client retention in an era of commoditized brokerage depends on the ability of investors to access—and for online brokers to provide—services, data, research and information that clients will find valuable, either for individual trades or for overall portfolio construction.

A neutral survey by Trade-Ideas ascertained specifically the value of these retention and acquisition elements to individual investors from those of most immediate importance and urgency to least important. Below are some of the results and insights.

The Trade-Ideas Retail Servicers Survey

The Trade-Ideas survey was straightforward and designed to confirm three significant developments with which retail investors (and by extension online brokers in general) are wrestling.

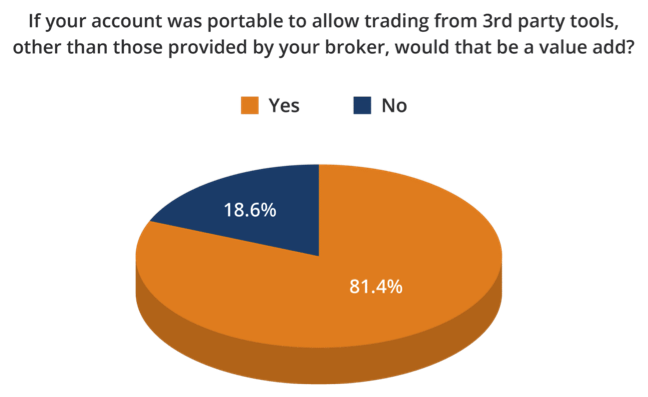

The first question dealt with third party trading and the ability to connect to a broker of the client’s preference and trade.

What this 81.4% response suggests is that independent service and utility providers can be a source of new client acquisition (and their attendant liquidity) for brokerage firms, depending on the robustness of their execution API. However, the downside from the brokers’ viewpoint is that empowered clients may have a new choice as to where to take their trades if they have accounts at multiple brokers.

This is not to say that these third-party providers cannot also be accessed as well through a broker’s platform. And increasingly, as these services grow more robust, online brokers seek out third party APIs, which they can then integrate into their brokerage platforms rather than the providers’ platforms/GUIs.

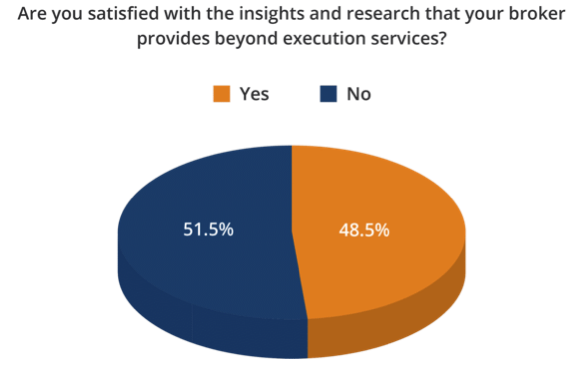

The second question dealt with the relative satisfaction and dissatisfaction with brokers’ information, data, and research provision. The split was fairly even, with some 48.7% of respondents satisfied and 51.5% expressing dissatisfaction.