What these results indicate is an opportunity that in a world of commoditized execution, essentially one out of two clients are not satisfied with the information they are receiving to inform their trading strategy and decisions making.

Should brokers want to retain and grow the number of clients (and they do), they will need to examination their current services against those desired by clients and to fill in the gap(s). It is this question that was the final issue addressed by the survey.

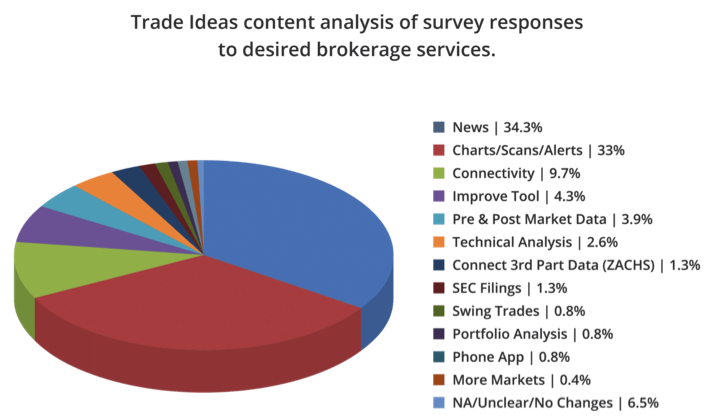

This final question was a qualitative analysis of the services that clients would like to see. The relative importance of each request relative to the others was determined by a content analysis of the number of times a service was mentioned by respondents.

As can be seen connectivity, news and visualization are the highest rank categories. Interestingly, this ranking ties to the general trends of increased retail importance in the overall market picture. Results reflect the increasing sophistication of clients as traders: real time news indicates that they know news moves prices; visualization means they will rely on the same sophistication that institutional traders routinely accept as the norm: and connectivity shows an immediate need for execution before the market gets away from them. It also is an indication overall that retail investors sense some recognition of their power to provide liquidity and affect execution price. Accordingly, they are beginning to flex their muscles. Savvy online brokers will not only meet but anticipate their demands and deliver ahead of time.

Conclusions

That there has been a shift in market dynamics and that retail investors are likely to remain "sticky," signals that servicing their needs will be increasingly important. Among these needs are a greater appetite for active trading strategies and decision tools that enhance performance in these approaches.

Set against the backdrop of changes that have occurred over the last year, success will belong to brokers who retain and attract investors with the tools they need, delivered in the way they want. This means either directly through the brokers' platforms or independently through connectivity to and from a service provider platform.

The Institute for Innovation Development is an educational and business development catalyst for growth-oriented financial advisors and financial services firms determined to lead their businesses in an operating environment of accelerating business and cultural change. We position our members with the necessary ongoing innovation resources and best practices to drive and facilitate their next-generation growth, differentiation, and unique client/community engagement strategies. The institute was launched with the support and foresight of our founding sponsors—NASDAQ, Ultimus Fund Solutions, Pershing, Fidelity, Voya Financial and Charter Financial Publishing (publisher of Financial Advisor magazine).