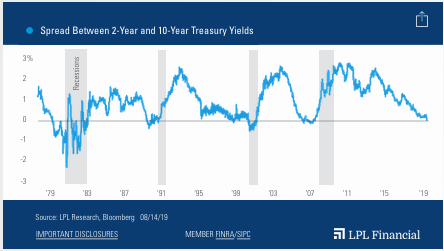

A closely watched point on the Treasury yield curve has fallen negative for the first time in this economic cycle.

As shown in the LPL Chart of the Day, Yield Curve Inversion Raises Economic Questions, the spread between the 2-year and 10-year Treasury yields fell as low as -2 basis points (-0.02%) in trading on August 14.

Typically, yield curve inversion, when long-term yields fall below short-term yields, is viewed as a signal of oncoming recession, although often with a relatively long lead. In the past five economic expansions, the U.S. economy has peaked an average of 21 months after the spread between the 2-year and 10-year yields initially turned negative.

U.S. Economy Remains On Solid Footing

Even though we’re discouraged by the yield curve’s shape right now, we see few signs of danger ahead. Data shows the U.S. economy is on solid footing, and corporate debt spreads have remain contained in this latest bout of volatility. Financial conditions are still historically loose, yet there are few signs of excess in the financial system. U.S. stocks have also been resilient against yield curve inversions in the past: Historically, the S&P 500 Index has rallied an average of 22% from the first inversion to the eventual economic peak.

“We’re not convinced that this yield curve inversion is a sign of imminent recession,” said LPL Research Chief Investment Strategist John Lynch. “The U.S. labor market is at full employment, healthy wage growth is fueling strong consumer activity, and corporate profits are at record levels.”

Global Perspective

Of course, recessions can be self-fulfilling prophecies of market sentiment, and we take that risk seriously. However, it’s a curious time for global fixed income right now, and Treasury yields have been weighed down by intense global buying pressure amid ultra-low sovereign debt yields elsewhere. Because of this, we think the yield curve’s shape has been driven more by technical factors than domestic economic weakness.