"By and large, it looks like most infrastructure ETFs have generally done decently over the last year," he says.

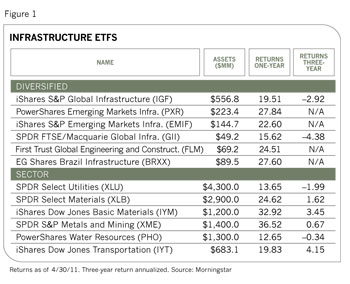

The good performance often depends on where you're looking. The largest multi-sector ETF in the category, the iShares S&P Global Infrastructure Index fund (IGF), lagged the total return for the S&P 500 index over the one and three year periods ending with the first quarter of 2011. But another offering, the iShares S&P Emerging Markets Infrastructure Index (EMIF), is well ahead of both the S&P 500 and the iShares MSCI Emerging Markets Index (EEM) over the last year.

Industry focus also plays a key role. With the nascent upturn in the U.S. economy and increased demand from emerging markets, ETFs that key in on industrial materials have surged while others, including those with a strong utility focus, have only muddled along.

Emerging Markets

Two funds, the PowerShares Emerging Markets Infrastructure fund (PXR) and the iShares S&P Emerging Markets Infrastructure fund, zero in on China, Brazil and other developing countries.

The iShares ETF is a focused offering that follows just 27 stocks. Its largest holding, Brazilian gas distributor Ultrapar Participacoes, accounts for 13% of assets. Its largest sector is electric and gas utilities (33%), followed by transportation infrastructure (29%).

The PowerShares ETF has about three times as many stocks as that, and only 3% of its assets are in utilities. Because it focuses mainly on basic materials (42%) and industrials (55%), it is more sensitive to commodity prices than the iShares offering. It includes companies involved in construction and engineering; construction machinery and materials; and diversified metals and mining.

The iShares fund zeroes in on China and Brazil, and each country holds approximately 30% of the fund's assets. The PowerShares casts a wider geographic net, holding 12% of its assets in China, 11% in Brazil, 10% in the U.S. and 9% in South Africa.

While the ETFs may have some overlap with broader emerging market funds, they aren't a proxy for them. The Vanguard MSCI Emerging Markets Index ETF (VWO), the most popular emerging market fund, has nearly one-quarter of its assets in financial services and another 13% in technology. Those two sectors, as well as consumer discretionary and health care, are virtually absent from the emerging markets infrastructure funds. Their track records also differ. In 2010, for example, the Vanguard fund had a total return of 19.5%, versus 26.2% for the PowerShares fund and 18.7% for the iShares fund.

Three infrastructure ETFs offered by Emerging Global Advisors focus on single countries. The sector weightings in the EGShares Brazil Infrastructure (BRXX), EGShares India Infrastructure (INXX) and EGShares China (CHXX) funds are based on each country's respective dominant industries. In China, for example, the fund has 24.5% of its assets in construction and another 23% in real estate, while the Brazil offering focuses more heavily on electric utilities and industrials.