Some notable portfolio managers grab headlines, make frequent appearances on financial-market television shows and, in extreme cases, attain rock star status. That will likely never happen with any of the people calling the shots at Dodge & Cox’s seven mutual funds. Why? Because each product is run by a multi-member investment committee in which everyone has equal say about what securities go into and out of a portfolio.

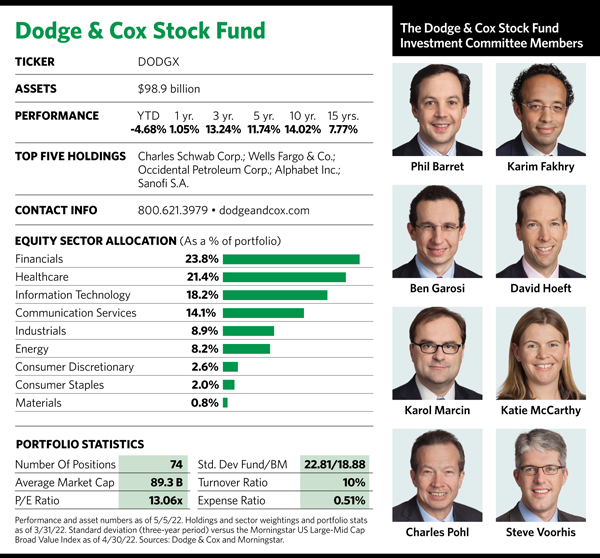

“It really is a team effort; it’s not just a manager backed up by a team,” says Steve Voorhis, research director and one of eight investment committee members on the Dodge & Cox Stock Fund. “Pretty much everything we do on the investment committee is collaborative and team-based.”

Members who achieve investment committee status typically work on two or three of the company’s funds, and most are analysts who cover specific sectors either in the equity or fixed-income spheres. They work with other research analysts at the firm who cover particular sectors; each analyst is paired with a research associate, a setup that Voorhis says enables Dodge & Cox to dig deeper into investable securities.

It’s a system that has produced time-tested, category-beating results for the 57-year-old Stock Fund. The portfolio comprises more than 70 medium- to large-cap stocks that investment committee members chose because they believed they were temporarily undervalued by the stock market but had favorable long-term growth prospects.

The fund has placed in the top quartile of Morningstar’s large-value category during the three-, five-, 10- and 15-year time periods (as of the first quarter). Granted, this year has been rough on the fund, which had lost 4.7% by May 5. That’s a slight underperformance compared to its category, though it’s better than the 6% loss suffered by the Russell 1000 Value Index, which is one of two benchmarks that Dodge & Cox uses as a comparison for the Stock Fund. The other benchmark is the S&P 500, which Voorhis says is more representative of its investment universe. That was down 13% by May 5.

But like any fund manager (or in this case, fund managers) who espouse a long-term investment horizon, the people behind the Dodge & Cox Stock Fund aren’t sweating the recent downdraft. They consider themselves contrarian investors, and sometimes that produces short-term hiccups on the path to longer-term gains.

One example relates to how they played the energy sector when that got slammed during the early days of the pandemic. “Two years ago we significantly added to our energy holdings at a time when energy prices were negative for a few days,” says Phil Barret, a Stock Fund investment committee member. “We thought about the range of outcomes over the next three to five years, and supply and demand in this sector.”

During those dark days for the energy sector, the fund’s managers leaned heavily on the firm’s fixed-income and credit group to gauge the short- and medium-term liquidity and financing capacity of certain companies in that sector. “That work gave us confidence—in that while energy prices were negative, our holdings had the benefit of time and could weather the volatility until prices recovered,” he says.

More recently, the fund in the first quarter added to its position in Meta Platforms, formerly known as Facebook, whose stock got walloped after it reported disappointing earnings in February that blindsided investors. “That position is illustrative of our long-term, bottom-up investment horizon,” Barret explains, adding that price dislocations in quality companies with solid three- to five-year growth prospects present intriguing buying opportunities.

“It enables us in certain circumstances to buy fast-growing franchises that might not be considered a prototypical value stock,” he says.