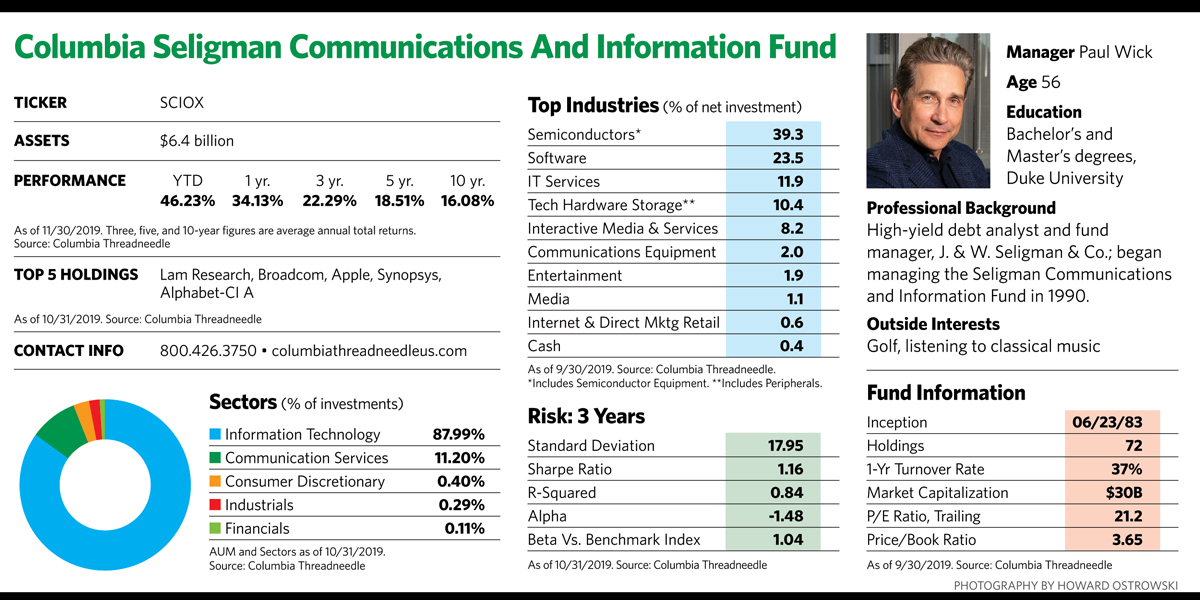

Wick’s educational background, which includes liberal arts and graduate business degrees from Duke University, did little to prepare him for the complex world of tech stocks that he’s navigated for nearly three decades. He credits a deep analyst bench with educational and professional technology expertise with helping him separate the companies with the most promising products from those more likely to hit the tech dustbin.

Avoiding Fads

In his search for value, Wick has long avoided faddish, hit-driven businesses that risk uncertain staying power, face lots of competition, suffer low profit margins and experience declining market share. He also watches a stock’s market activity and steers clear of companies with significant insider selling by management, dwindling institutional ownership and high levels of short selling.

He cites online used car retailer Carvana as a hype-driven company that investors are paying way too much for. “Basically, this is a glorified retailer burning over one-half billion a year in cash [and] trading at over three times revenue,” Wick says. “Netflix, Wayfair, Uber are just a few other examples of companies that are burning through cash like crazy. The same holds true for the publicly traded companies that sprang up after the legalization of marijuana and are losing money. Meanwhile, semiconductor companies remain profitable.”

Companies that capture his attention must have strong current or near-term profit margins and cash flow, recurring revenue, differentiated intellectual property and high barriers to entry. Those that are logical takeover targets, as well as those that make value-enhancing acquisitions, also get preference. He is most likely to buy when investor misunderstanding or under-coverage by analysts is making the stocks cheap, as long as analysis reveals that recovery is likely.

The fund’s top two holdings, Lam Research and Broadcom, are sweet spot companies for Wick. Lam, a Fremont, Calif., company founded in 1980, makes advanced microchips. The fund first invested in the company in 2012 after Lam acquired another fund holding, Novellus, in a stock transaction. Since then, the revenues of the enterprise formed from their combination have grown from $2.8 billion to nearly $11 billion. Lam has not made any other acquisitions since then, so that growth has been entirely organic.

The company’s active share buyback program shrank its share count by 13% over the last year, a move that has helped its earnings per share—the figure was at $14.55 for the fiscal year ending June 2019, down from the same period in 2018, but Wick thinks earnings could increase to $18 or $20 a share in 2020.

Broadcom, a company with a history of prudent acquisitions, is a longtime top 10 holding in the fund and has branched well beyond semiconductors. A little over a year ago, the company announced it would acquire CA (the old Computer Associates), the last major public mainframe software company. While many investors were skeptical of Broadcom’s foray into enterprise software, CA has added significantly to earnings. In November, Broadcom acquired the enterprise security software division of Symantec for $10.7 billion.

“Investors have become wary of Broadcom’s acquisitiveness, which brings some uncertainty and has pressured the stock,” observes Wick. “But in prior transactions, Broadcom’s management has significantly reduced costs in the acquired company and successfully integrated them into Broadcom’s portfolio of businesses. The company has the best management team and the highest profit margins in the global semiconductor industry.”