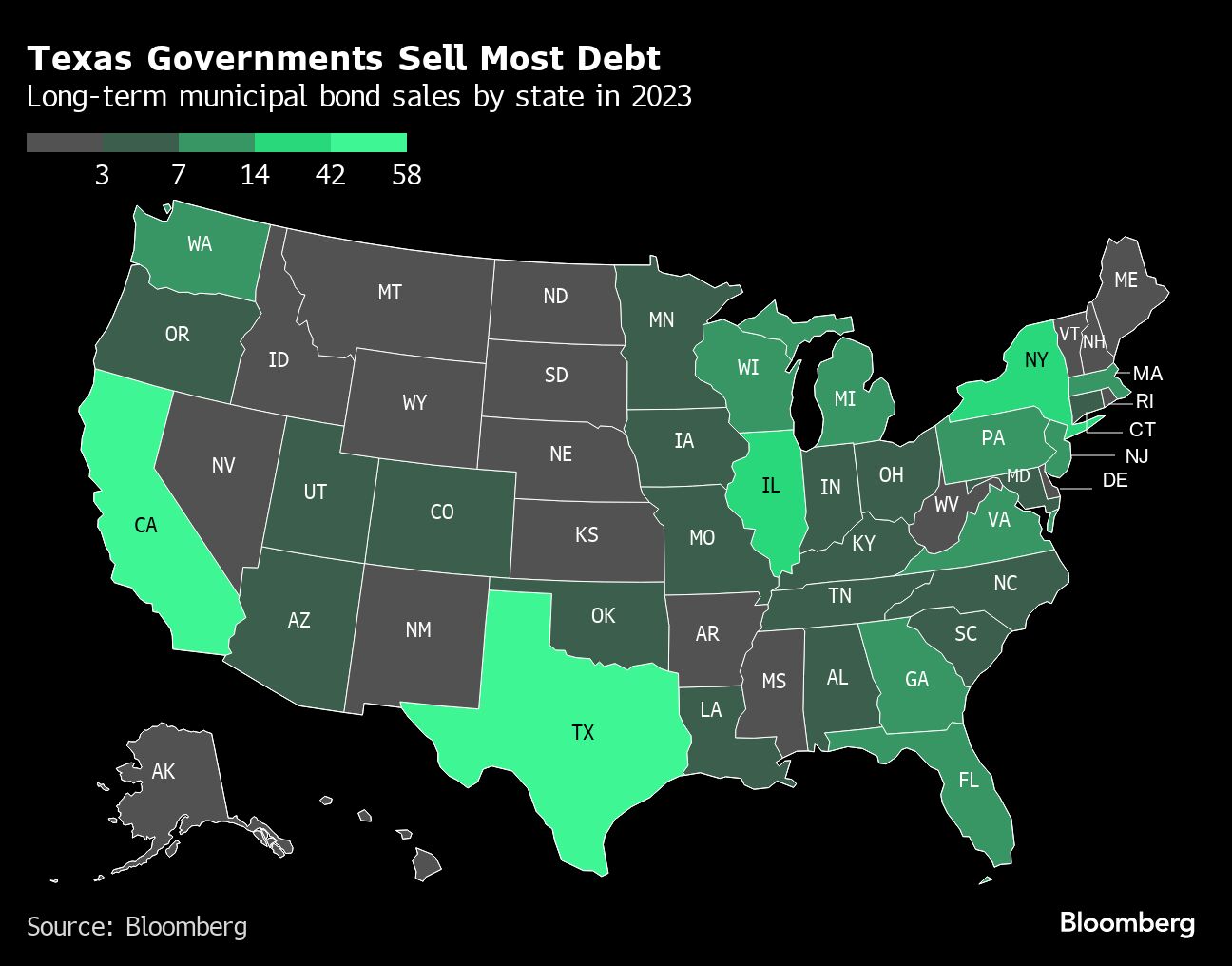

Texas governments sold more debt that any other state this year, issuing $58 billion of bonds to finance school construction, water utility projects and airport improvements as its population surged.

It’s the first time since at least 1990 that Texas municipal bond sales outpaced the debt-heavy powerhouses of both New York and California, according to data compiled by Bloomberg. The jump came even as borrowing costs hovered near decade-highs for much of the year and other governments pulled back on tapping the market. It’s the second highest yearly volume for Texas governments, dwarfed only by sales in 2020 when municipal benchmark rates fell to 0.5%.

“The one place you want to be a muni banker this year and going forward is in Texas,” said Keith Richard, senior managing director and head of the Texas region at Siebert Williams Shank & Co.

At the center of the bond boom is Texas’ increasing population. The state joined California as one of only two states to eclipse 30 million people in 2022, according to US Census Bureau figures. And the growth has been rapid, spurred by a lower cost of living and the state’s business-friendly environment. Since the turn of the century, Texas gained more than 9 million residents, the most of any state and 3 million more than Florida, the next largest influx. Eleven of its counties saw populations more than double in the past two decades.

“There are areas that are booming and with all this growth, comes with massive infrastructure needs,” Richard said.

Those needs include ready-to-build projects to keep pace with the population, like bigger airports, more roads and larger schools. And existing infrastructure needs to be strengthened against major weather-related events, which have become more common. The largest Texas bond sale this year was a $3.5 billion transaction to bail out natural gas utilities that incurred billions of dollars of unexpected costs during a deadly winter storm in 2021.

Despite the boom in sales, Texas’ muni market hasn’t been an easy place to do business for public finance bankers. In 2021, lawmakers enacted a pair of laws targeting Wall Street banks for their policies on firearms and fossil fuels — a decision that upended municipal bond underwriting in the state.