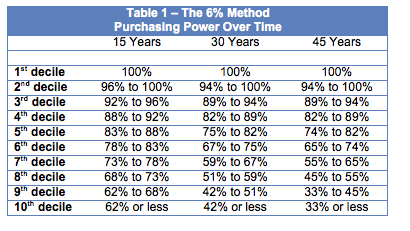

There’s a 50 percent likelihood that your purchasing power will be at least 83 percent of your original purchasing power in year 15, at least 75 percent of your original purchasing power in year 30 and at least 74 percent of your original purchasing power in year 45. Also, there’s an 80 percent chance that your purchasing power will be at least 68 percent of your original purchasing power in year 15, at least 51 percent of your original purchasing power in year 30 and at least 45 percent of your original purchasing power in year 45. You or your client may be willing to take this risk in order to start retirement with 50 percent higher portfolio withdrawals.

Note that as long as purchasing power is 67 percent or more, your withdrawals are still higher than if you had followed the four percent rule. Since purchasing power at the bottom of the sixth decile at 30 years is 67 percent, there’s a 60 percent likelihood that withdrawals under the six percent method will never be less than under the four percent rule during the first 30 years of retirement. Also, since purchasing power at the bottom of the sixth decile at 45 years is 65 percent, there’s a 60 percent likelihood that withdrawals under the six percent method will never be less than 97.5 percent (= six percent times 65 percent divided by 4 percent) of your withdrawals under the four percent rule during the first 45 years of retirement.

Conclusion

The six percent method is a withdrawal strategy that allows retirees to initially spend 50 percent more than the four percent rule with essentially the same probability of sustaining their portfolio long-term. However, the price for higher initial withdrawals is the risk of a purchasing power decline over time.

Even if you choose not to adopt the six percent method in practice, this analysis demonstrates that initial withdrawal rates up to six percent are safe as long as you don’t increase withdrawals from year to year when your portfolio withdrawal rate exceeds six percent.

David M. Zolt, CFP, EA, ASA, MAAA, is a comprehensive, fee-only financial planner and president of Westlake Advisors, a registered investment advisor in Westlake, Ohio. He is the developer of The Retirement Planner software (www.RetireSoft.com). Contact him at [email protected].