For completeness, the fourth type of bubble is what is known as an informational bubble. I am not going to dwell on this kind of bubble here as I don’t believe it is apposite to the current situation. Suffice to say, this is a situation in which people stop acting on their own private information and start acting on the revealed information of others. You can think of it as an investor saying, “Well I think the U.S. market is expensive, but all these other investors can’t be wrong, so I will override my own view and buy because they must be right.” A touching faith in the wisdom of crowds, if you will.

So, I agree with Jeremy that many of the psychological hallmarks of the fad or mania are absent. But to me today’s is a cynical bubble, built not on faith in a new era, but on overoptimism about the ability to get out before everyone else. As Keynes opined,

The actual, private object of most skilled investment today is to ‘beat the gun’… This battle of wits to anticipate the basis of conventional valuation a few months hence, rather than the prospective yield of an investment over the long term, does not even require the public to feed the maws of the professionals; it can be played by professionals amongst themselves.

Experimental Evidence

To help bolster the case that not all bubbles require euphoria, we can turn to the experimental asset market literature, which is based on the premise that most of the elements of the market can be controlled in a way that simply isn’t possible in the real world.

For example, let’s assume that the asset being traded has a known life, with an expected dividend paid in incremental periods during that life. The dividend payout varies depending upon four equally likely states of the world, and the amounts paid under each outcome are known. The asset has zero worth at the end of the game. Thus, the expected value of the assets is the payout of each state of the world multiplied by the probability of each state of the world multiplied by the number of periods left in the game.

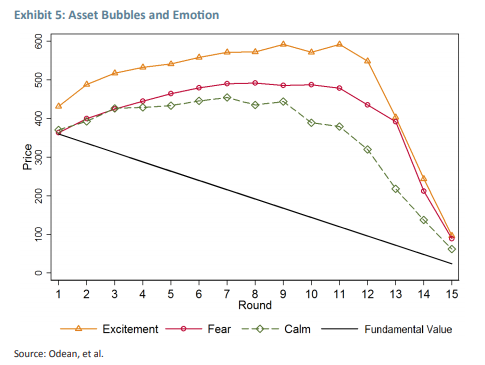

It is well known that such markets can witness bubbles wherein asset prices are significantly above their intrinsic value. However, in this particular case we are interested in the impact of emotion upon the scale of the bubble. Odean, et al.5 investigated exactly this.

They simulated various emotional states by having participants watch a variety of video clips. To simulate excitement, they were shown car chases; to simulate fear, horror films. A base condition was achieved by showing participants a neutral historical documentary.

Exhibit 5 shows the results of the experiment. Fundamental value slopes downwards from left to right, decreasing by an amount equal to the expected dividend each period. However, each of the emotional states and the neutral condition created bubbles. That is to say, prices traded miles above intrinsic value. For instance, if we look at round 7, we can see that prices are, at minimum, approximately twice fundamental value.

Now, to get a really monster bubble, the participants needed to be feeling very excited (euphoric). This created a bubble that in round 9 was three times intrinsic worth. So, to get a true Mania and the associated bubble it would appear that optimism was a necessary condition. But to get run-of-the-mill bubbles, it simply wasn’t required.