We also have experimental evidence on just how hard it is to be one step ahead of everyone else, which is presumably what the bubble riders are intent upon doing. Indeed, the aforementioned fund manager survey shows that nearly 70 percent of fund managers expect the equity markets to peak at some point this year.

As Keynes noted,

Professional investment may be likened to those newspaper competitions in which the competitors have to pick out the six prettiest faces from a hundred photographs, the prize being awarded to the competitor whose choice most nearly corresponds to the average preferences of the competitors as a whole; so that each competitor has to pick, not those faces which he himself finds prettiest, but those which he thinks likeliest to catch the fancy of the other competitors, all of whom are looking at the problem from the same point of view. It is not a case of choosing those, which, to the best of one’s judgment, are really the prettiest, nor even those which average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.

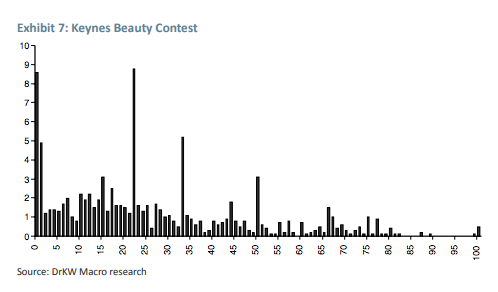

A game based on this idea can be constructed where participants are told to choose a number between zero and 100. The winner will be the person who picks the number closest to two-thirds of the average number picked.

In one of my previous existences, I set up such a game. The players were all professional investors and I had over 1,000 participants (making it the fourth or fifth largest game played, and the only played purely by professional investors).

The fact I got a number of answers above 66 is a little disturbing! The highest possible answer is 66, because to pick this one must believe that everyone else has just picked 100. In Exhibit 7, you can see spikes at various levels of induction. The average number picked turned out to be 26 (which is fairly typical of such games), and thus the two-thirds average was 17.4. It proved incredibly hard to be one step ahead of everyone else in this game.

Bursting Cynical Bubbles

I have already confessed a pathetic lack of ability when it comes to timing a bubble’s demise. It is one of the many reasons I regularly extol the concept of patience as a symbiotic to following a value-based approach.

However, I do know that cynical bubbles are based on a belief that one can get out before everyone else. Obviously, this is simply impossible. Like a game of musical chairs played at a child’s birthday party, when the chairs are increasingly rare, the competition for them gets fiercer. Crowded exits don’t end well—inevitably some are crushed in the stampede.