The super-rich (those with a net worth of $500 million or more) are increasingly choosing to establish single-family offices to address many of their needs. In comparing what else is available—in the form of private banks and wealth managers, lawyers and accountants—single-family offices have proved to be the superior providers.

Because of the structure and dynamics of these offices, they can provide the bespoke solutions super-rich families need and want. But since the family that the office is formed to serve is driving the decision-making, its operations are not all geared to making a profit.

If a single-family office is not viable for them, wealthy families might prefer multi-family offices to the more traditional providers. This way, a much larger subset of affluent people, in many cases those with between $10 million and $20 million, can enjoy the same advantages that single-family offices offer to the super-rich.

What A Multi-Family Office Delivers

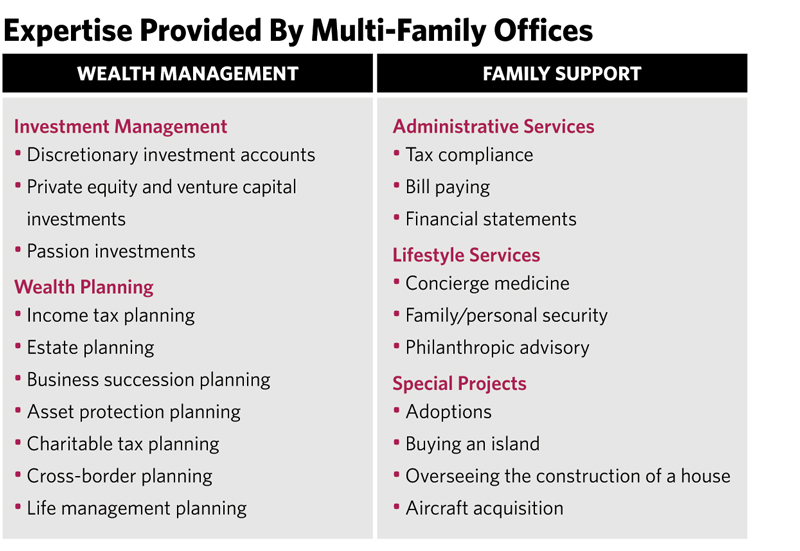

Generally speaking, multi-family offices tend to provide two major categories of expertise: wealth management and family support (see the chart). Wealth management consists of investment management and wealth planning. Family support tends to include administrative and lifestyle services, as well as special projects.

Let us dig a little deeper into each of the categories.

Investment management: Investment management is a cornerstone capability of many multi-family offices. There are familiar investments that these offices make, though the patterns can change easily as social, economic and family circumstances change. So a well-connected multi-family office is inclined to invest almost anywhere it sees profit, as long as the investments meet specified criteria.

Though the investment experts usually work in-house, the multi-family office also likely uses outside investment managers. However, the investment philosophy, strategy and asset allocation, as well as the selection of external managers, is done by the in-office professionals, who also evaluate investment performance.

Wealth planning: For some wealthy individuals and families, wealth planning is much more important than investment management, since wealth planning can often deliver more predictable outcomes: It often involves legally muting the family’s tax burden, protecting assets from frivolous lawsuits, enhancing the impact of charitable gifts and ensuring the continuity of family values and the family fortune.

The following are the most common specialties within wealth planning:

• Income tax planning focuses on blunting the tax bite on money earned by working.

• Estate planning involves using legal strategies and financial products to determine the future disposition of current and projected assets.

• Business succession planning principally deals with the operational and often tax-efficient transitioning of businesses to others, whether it’s to family members or somebody else.

• Asset protection planning entails employing legally accepted concepts and strategies to ensure that a family member’s wealth is not unjustly taken from him or her.

• Charitable tax planning enables tax-efficient philanthropy.