When a big recession hits, monetary policy often isn’t able to do the whole job of getting an economy back to full employment. Interest rate cuts eventually push rates to zero, which they can’t go much below. Alternative tools like central-bank forward guidance and quantitative easing can help, but even these are limited. At some point, the government needs to start spending money to give the economy a boost. Fortunately, economists generally agree that fiscal stimulus is important and effective at helping battle economic slowdowns.

But fiscal stimulus is politically difficult. Unlike monetary policy, which can be changed rapidly by the decisions of a few central bankers, federal government spending must typically be approved by an act of Congress. But Congress may not move quickly enough; by the time debate is resolved, a bill passed and spending actually begins, the recession may have already been allowed to grind on for many months. For example, the Great Recession officially began in December 2007, but the American Recovery and Reinvestment Act (commonly known as the Obama stimulus) wasn’t passed until February 2009.

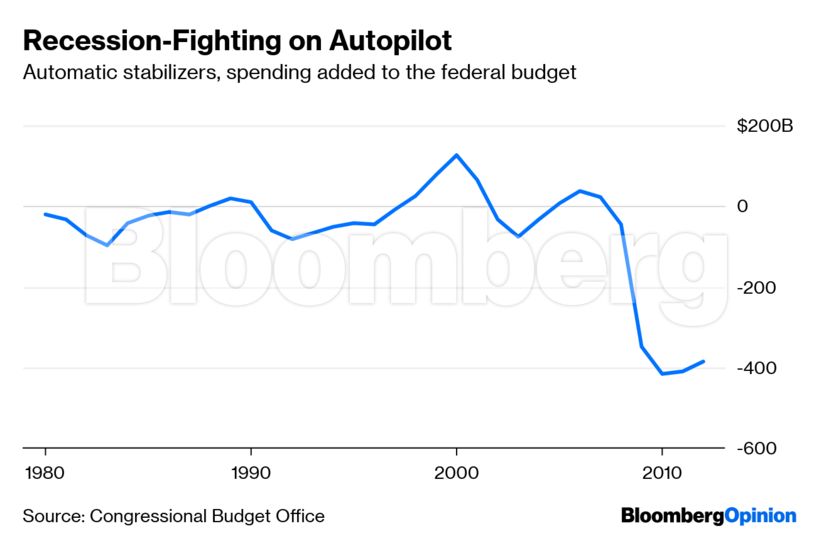

Enter automatic stabilizers, the unsung heroes of recession-fighting. These are spending and tax policies that tend to be triggered automatically when there’s a recession and recede when there’s a boom. For example, when the economy slumps, more people claim food stamps, unemployment insurance, housing vouchers and other benefits that go either to those with low incomes or those who are out of work. Similarly, when people’s incomes drop because they get laid off, their taxes go down, which helps them maintain their consumption through the bad times. The Congressional Budget Office estimates that these automatic stabilizers amounted to hundreds of billions of dollars in fiscal stimulus during the Great Recession:

Automatic stabilizers are good because they happen much quicker than stimulus legislation, and therefore start fighting a recession as soon as it happens.

There’s plenty of scope to expand automatic stabilizers. First of all, simply increasing federal and state benefits for poor people will improve the economy’s resilience to recession. Lower-income Americans’ spending tends to fluctuate much more with the condition of the economy, probably because they are financially constrained and unable to borrow to make it through bad times. Macroeconomists Ricardo Reis and Alisdair McKay argue that increasing spending on programs like food stamps will make aggregate demand much more stable. Other economists have made the case that Europe’s generous social insurance policies have helped reduce macroeconomic volatility there.

Expanding social programs costs money even in good times, which adds to budget deficits over the long term. If the government wants to avoid committing to larger structural deficits, it can design spending programs that only kick in, or only ramp up, during recessions. Many economists are now proposing ideas for how to do this. For example, Ben Spielberg of the Center on Budget and Policy Priorities, a think tank, has suggested a program that increases the share of Medicaid costs paid by the federal government as soon as growth drops. Others have suggested disbursing more infrastructure funds, welfare payments and federal assistance to state governments when the economy slows down.

An even more ambitious idea comes from economist Claudia Sahm at the Federal Reserve Board. Under Sahm’s proposal, the federal government would simply mail checks to all Americans when a recession hits:

Lump-sum…payments would be made to [all] individuals…when the national unemployment rate rises by at least 0.50 percentage points. The…individual payments would [total either] 0.7 percent of GDP, or 1 percent of personal consumption expenditures.

This formula is now being called the Sahm Rule.

The Sahm Rule would be quite a big stimulus. If these direct payments had a fiscal multiplier of two -- in other words, if each dollar of payments stimulated an additional dollar of private spending as the money worked its way through the economy -- then it would raise growth by about 1.4%. Since every percentage point of growth tends to lower unemployment by about a third of a percent -- a relationship known as Okun’s Law -- this would cancel out essentially all of the 0.5% rise in unemployment that triggered the spending.