On Saturday morning, I learned that the U.S. election had at last been called for Joe Biden from the sound of car horns honking in the streets outside, soon followed by singing and the noise of people leaning from their windows and banging pots and pans. My neighborhood, Washington Heights at the northern end of Manhattan, is utterly unrepresentative of the country as a whole; overwhelmingly Latino and very liberal, with the local Democratic Congressman receiving more than 90% of the vote. It’s not surprising, therefore, that the news was treated as the excuse for a vintage Latin fiesta in the streets.

It is more surprising that global stock markets seem to have treated it the same way.

At the time of writing, trading in S&P 500 futures in Asia suggests that a new all-time record, for the first time since early September, is a real possibility. They are rallying strongly again:

As I wrote last week, the narrative is already well established that divided government, with a relatively moderate and market-friendly Democratic president countered by a slim Republican majority in the Senate, should be perfect for stocks. (And divided government we will almost certainly have, although there is a slim chance that Democrats could force a tie in the Senate if they win two run-off races in Georgia in the first week of January). To this can be added the basic market physics that there was pent-up demand for another rally. The reduction in perceived risk also means a weaker dollar (because people feel less need to shelter in U.S. assets), which in turn helps American securities prices.

There are plenty of reasons to buy or sell stocks that have nothing to do with U.S. politics. There always are. But something significant has changed this week, and a lot of uncertainty has been removed. What real reasons have these changes given us to feel more or less bullish about U.S. stocks under President Biden?

The Bullish Case

As president, Biden will have sweeping powers over trade policy, as Trump has demonstrated. The last thing he needs is a continuing trade war with China. He would have no guarantee of winning, and the latest trade figures from Beijing suggest that the build-up in tension under Trump has done minimal damage to the Chinese export complex:

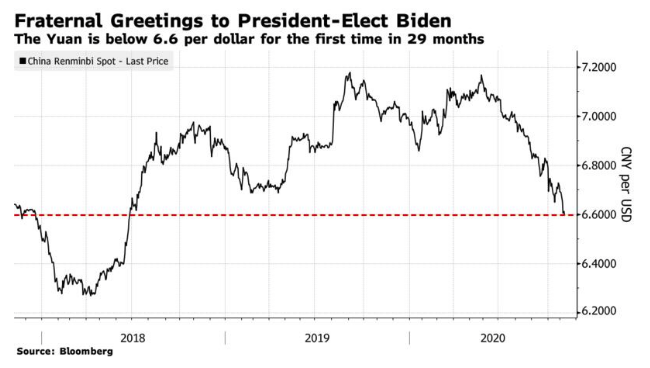

If there is anything the markets haven’t liked about the current president, it is his trade policy and its unpredictability. A look at the Chinese currency, which has been wielded as a weapon during the hostilities, shows that Beijing is now extending the hand of welcome. The yuan is its strongest against the dollar since Trump started to amp up tariffs and rhetoric in the summer of 2018: