Scenario 3: December 31, 1999, to December 31, 2013

Key To Successful Implementation

Conclusion

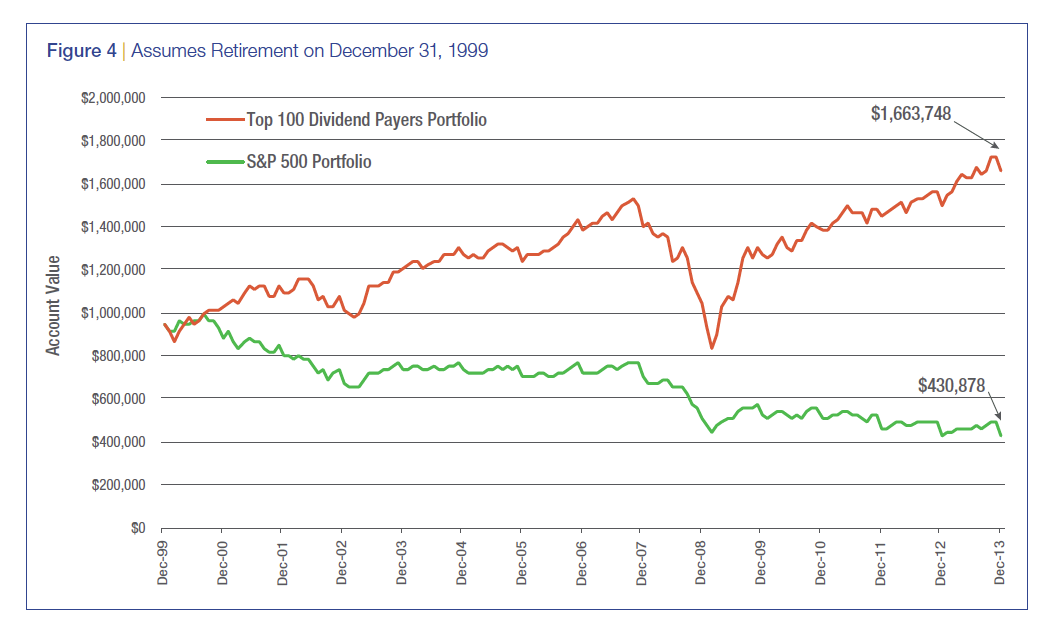

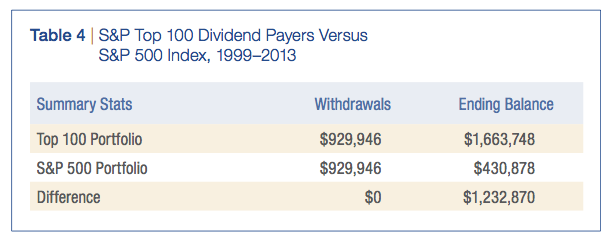

To illustrate a retirement that began just before the 2000 bear market, we began on December 31, 1999. Figure 4 illustrates that over a short 14-year time frame, the Top 100 Dividend Payers portfolio has been far superior to the S&P 500 Index portfolio. Given the drop in value of technology and growth stocks during this time frame, the outperformance of the dividend-focused approach was no real surprise, but the magnitude was a surprise. A retiree who began taking withdrawals from the dividend-focused portfolio at the start of the 2000 bear market was able to spend an equivalent amount and have a corpus more than three times as large versus the S&P 500 Index portfolio (see Table 4). Just think how fortunate this retiree was coming into the market tumult we have seen since 2008.

Impact on SAFEMAX

Having seen that the dividend-focused strategy improves the sustainability of a retirement portfolio in distribution, we wanted to determine how much the withdrawal rate could be increased without negatively affecting the portfolio’s sustainability. Given the multiple variables, we decided it best to pose this question to Bengen. He agreed to study the impact of the dividend strategy on his SAFEMAX, or maximum sustainable withdrawal rate. We provided Bengen with the S&P Top 100 Dividend Payers database of monthly returns, which he processed through his model.

Substituting Top 100 Dividend Payers for S&P 500 Index stocks had very beneficial effects on the SAFEMAX for retirees during the 1968–1975 periods. The SAFEMAX was increased by about 25 percent during this period, which translates into a significant improvement of lifestyle for those retirees. Investors in the 1956–1967 periods, who had “hybrid” equity allocations of the first 100 percent S&P 500 Index stocks, then Top 100 Dividend Payers beginning in 1968, also saw very substantial increases in their portfolio longevity.

Bengen’s conclusion focuses on the impact that a dividend-paying strategy had on retirees who began retirement between 1956 and 1967. This time frame is of particular interest given the devastating effects that the bear market of 1973–1974 and a concurrent period of high inflation had on retirement portfolios. To paraphrase, this 25 percent increase in the annual withdrawal rate allows the spending amount to be raised from $40,000 to $50,000 per year plus an annual cost-of-living adjustment. Therefore, the high and growing dividend strategy dramatically improves the quality of the client’s retirement years.

Finding companies that have both the willingness and ability to increase their dividends over time is the key to successful implementation of this retirement income strategy. If you limit your universe solely to U.S. stocks, you will be focusing primarily on financial and utility companies for their higher dividend yields but may not end up with the desired growing dividend income stream. Looking outside the United States, you will find higher dividend-paying companies across almost all sectors as well as a greater inclination by company management to grow this dividend. This difference in dividend policy between domestic and foreign companies is cultural. In the United States, the primary measure of financial health is earnings, and chief executive officers are more inclined to re-invest the company’s capital on the next best idea in hope of attaining earnings growth. Companies outside the United States often are judged on their ability to pay a high and growing dividend, which is seen as a sign of financial health. In fact, looking at the market composites, estimated dividend yields averaged 2.1 percent in the United States, 3.7 percent in Europe, and 4.3 percent in the Pacific (excluding Japan). Although international investing comes with special risks, using a carefully selected portfolio of high-quality, global companies that pay a high and growing dividend can greatly benefit a retirement portfolio in distribution.

Financial advisors who view the retirement-income challenge as a process rather than a product will be successful gathering assets and consolidating accounts from our baby boomer brethren as we all move into retirement. This article shows that an allocation of a retirement portfolio’s equity to a high and growing dividend strategy can increase sustainability and improve retirement lifestyle via higher withdrawal rates.

Jan Holman, CIMA, CFP, AIF, is director of advisor education at Thornburg Investment Management.

The Case For A High And Growing Dividend Stock Strategy In Retirement Portfolios

October 15, 2014

« Previous Article

| Next Article »

Login in order to post a comment

Comments

-

Many of us veterans in the investment and planning worlds internalized your findings many years ago, and have all but rejected the income products to which you refer. The challenge is convincing nervous and I dare say, ignorant (not stupid, just ignorant of how the world's economy works) investors who have been approached by the product purveyors. More than anything else, if we have become teachers.