Mid-cap equities, like middle children, can often be overlooked. It is easy to be captivated by large-cap equities, with their impressive scale or an up-and-coming small-cap tech company that is slated to be the next big thing, but nestled between these two extremes are mid-cap companies. With market capitalizations ranging from $2 billion to $10 billion, mid-cap companies inhabit a sweet spot in the market, balancing growth potential and security.

Mid-cap equities include components of both small- and large-cap stocks. Small-cap equities can be unpredictable and volatile and large-cap equities may have already experienced most of their exponential growth. Mid-cap companies often offer a more balanced approach, with the opportunity for considerable growth along with better stability. In many instances, mid-cap companies are more than just a good idea. Many have a demonstrated history that they can prosper through various market conditions in their respective industries, providing investors with desirable returns.

Rapid growth and expansion are common traits of mid-cap companies; new ideas and products are generated and tested leading to market expansion and brand recognition. This growth potential can lead to significant capital appreciation over time, especially if these companies transition into large caps. Apple, Amazon, Alphabet and many other well-known large companies were once mid-cap stocks. Successful companies can experience significant growth over time, moving from mid- to large-cap status as their businesses expand and market capitalizations increase. Investing during the mid-cap phase can yield substantial returns if they continue to innovate and grow.

Another benefit of investing in mid-cap equities is that they typically trade at lower valuation multiples compared to large-cap equities. Investors can participate in companies with strong growth opportunities and avoid paying the premium valuations that typically accompany investing in large companies. For example, the price-to-earnings ratio for the Russell Mid Cap Index was 17.99 as of 8/31/2023, whereas the Russell 1000 index had a price-to-earnings ratio of 21.92.

Diversification benefits are another compelling reason to include mid-cap equities in an investment portfolio. A well-balanced and diversified portfolio allocates risk in a variety of ways, including across various asset classes and market capitalizations. Adding mid-cap equities to a portfolio of large- and small-cap equities can mitigate unsystematic risks pertaining to company size and certain sectors of the economy.

Market cycles are dynamic, and what has been performing well recently may not continue to do so. For many years, the markets have favored large technology stocks like Apple and Alphabet. The S&P 500 Index, which holds the 500 largest publicly traded companies in the U.S., including the large technology names, has become incredibly concentrated. As of mid-August, the largest 10 stocks in the index have accounted for around 90% of its year-to-date return in 2023. Investors looking to truly diversify their assets from a size and sector perspective might consider the addition of mid-cap equities to diversify some concentration risk away from the large-cap markets.

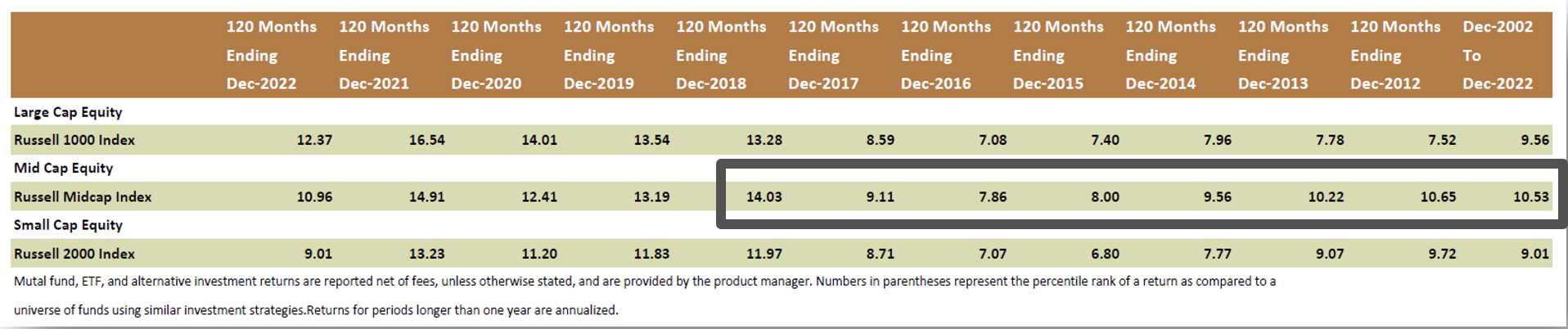

When it comes to performance, mid-cap equities have demonstrated their superiority over longer time periods. The Russell Mid Cap Index has outperformed large and small cap equities in a majority of the 10-year rolling time periods in the past 20 years as well as the 20-year return.

Mid-cap equities are often overlooked, but it is this underestimation that can make them a great opportunity. They can play a pivotal role for long-term investors, offering growth, diversification and valuation benefits. Rather than likening mid-cap equities to middle children, consider them more akin to the middle finger. While it might seem unremarkable at first glance, it can make a significant impact when employed effectively.

Sydney Aeschlimann is a senior analyst on the Retirement Plan Practice Group at Innovest Portfolio Solutions. Brett Minnick, CFA, is a vice president and consultant at Innovest.