Real estate is one of the oldest and most established investments. Most investors own a home and can appreciate how its value fluctuates based on improvements, market conditions, and supply and demand. It is often a family’s largest single investment.

Real estate investment trusts (REITs) have also emerged as valuable tools in providing growth and income. REITs have become a mainstream response to investors seeking yield in their portfolios or hedges against inflation. However, owning a home or owning publicly traded REITs is very different from investing in private properties.

Private real estate represents a broad and diverse set of opportunities. With roughly $34 trillion in assets under management globally, the U.S. represents 41% of the global market, with growing opportunities in Europe and Asia (27.7% and 23.7%, respectively).

Private real estate represents a broad and diverse set of opportunities. With roughly $34 trillion in assets under management globally, the U.S. represents 41% of the global market, with growing opportunities in Europe and Asia (27.7% and 23.7%, respectively).

Private real estate has been used primarily by large institutions and family offices because of its historical return, risk, and income profile. According to the CalSTRS 2022 Investment Policy Report, the pension’s real estate allocation is over 15%, above its target policy and higher than its 11% allocation to fixed income, given real estate’s relative attractiveness in the current market environment.

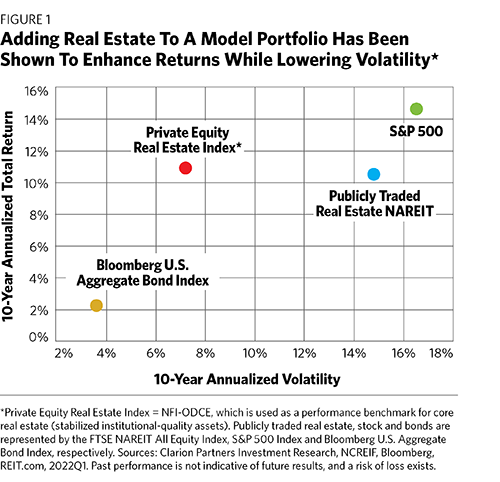

The appeal of private real estate is multi-faceted. Private real estate has historically delivered strong growth and income and diversification relative to traditional investments, and it can help in hedging the impact of inflation. As the data in Figure 1 illustrates, private real estate has delivered strong risk-adjusted returns relative to the S&P 500, other U.S. equities and publicly traded REITs.

What Is Private Real Estate

Private real estate is quite different from its public market equivalents. These properties represent a broad set of global opportunities, which have historically delivered an illiquidity premium—the excess return for tying up capital for an extended period of time. Private real estate has historically provided much higher income than traditional fixed income options and has exhibited relatively low correlation to traditional investments. The last advantage of private real estate is that it can be used to hedge against inflation, in part because of owners’ ability to raise rents to offset it.

Commercial real estate is one of the largest investible asset classes, and the largest category of real assets, representing 90% of the overall market. Over the years, the definition of commercial real estate has varied by investor. We define commercial real estate in the traditional sense—land (developed or undeveloped)—and properties that are used for commerce, business, and multi-tenant dwelling. These properties are leased to tenants to generate regular cash flow, similar to fixed-income investments.

There are four main types of commercial real estate: multifamily/residential, office, industrial/warehouse and retail. Within each type, there are different characteristics, each of which impact how the property type reacts to different market conditions.

Multifamily Properties. These properties are residential buildings with multiple housing units. They can be located in either urban or suburban markets, or be of different style such as high-rise, mid-rise or garden-style apartments, and their quality level can range from class A to class C depending on their condition, location and amenities. In the years following the 2008 financial crisis, some real estate sectors, notably residential, were plagued by underinvestment. Private real estate investors like Blackstone, Clarion and others eventually filled the void and profited handsomely.

Office Properties. Similarly, office properties can be stratified by their location, their number of tenants, and their quality level. Class A buildings are considered the highest quality properties, both in terms of construction and location. They are often prestigious buildings with premium rents. Class B offices are generally of good condition but of lesser quality and/or are in less desirable locations than Class A. They generally compete for a range of corporate tenants with rents that are average for their submarket. Class C office space is typically older and/or in unfavorable locations. These properties generally have below-market rents.

Industrial Real Estate. Industrial real estate encompasses an array of properties where activities such as production, manufacturing, assembly, storage, distribution, and research take place. They are frequently located outside of urban centers close to major transportation routes. There are five main types of industrial properties: heavy manufacturing, light assembly, warehouses, R&D offices, and flex industrial, which is a combination of industrial and office space.

Retail Properties. These properties are spaces used solely for the sale of goods and services. They can encompass the cafes, restaurants, banks, gyms, and shops we frequent and can be single-tenant or multi-tenant. They may be further classified by their size and location.