YUAN ACCEPTANCE

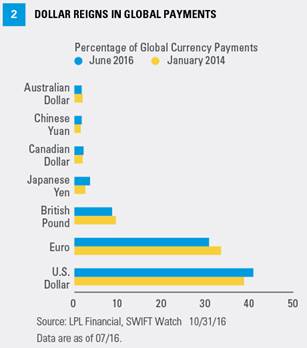

Although the yuan’s inclusion in the SDR represents a public relations victory for the Chinese government, the yuan has struggled for real acceptance as a global currency. The level of acceptance of the yuan can be measured many ways, though they all tell the same basic story. One way is to examine how various currencies are actually being used in global trade [Figure 2]. This shows that despite the inclusion of the yuan in the SDR basket and other measures by the Chinese government to promote its use, the world has been slow to adopt the yuan as a unit of exchange.

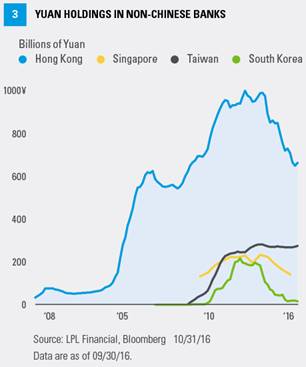

Another measure of a currency’s acceptance is the extent to which it is held outside of its home country. Being willing to hold a currency in a country in which it cannot be spent is perhaps the ultimate vote of confidence in that currency’s ability to hold its value. Indeed, holdings of the yuan increased significantly earlier this decade, mostly in other Asian countries, though this trend has reversed more recently [Figure 3].

Why have global participants been so leery to hold the yuan despite the vote of confidence from the IMF? The reasons are interrelated and pertain to a lack of trust in the Chinese government. One of the biggest fears is the continued devaluation of the yuan against other major currencies. A major devaluation would be in complete opposition to the policy of encouraging use of the yuan as a global currency. Indeed, the Chinese government has been struggling to maintain the value of the yuan; it has declined 5.8% this year against the U.S. dollar after years of almost no movement. However, as both people in mainland China and outside of it question the government’s ability and willingness to support the yuan, fewer people outside the country will be willing to hold it. A currency that no one wants to hold for an extended period will have little use in global trade.

CONCLUSION

The Chinese yuan’s inclusion in the IMF’s SDR program made big headlines when it was announced in November 2015, and this year, when the inclusion was formalized on October 1, 2016. Though there may be very long-term implications for this action, at this point it is almost entirely symbolic and poses no threat to the dollar. In fact, the dollar’s role as the world’s reserve currency has actually strengthened over the last few years. Weakness in the yuan and underlying concerns regarding the Chinese economy mean that the yuan’s ability to challenge the U.S. dollar as the global reserve currency, if even possible, is a long way from being a reality.

John J. Canally Jr., CFA, is the chief economic strategist at LPL Financial.