Why This Happens

There are a couple of reasons why this happens. The biggest is that policymakers hate losing face more than anything. They are unwilling to admit that a course of action is bad, so they will keep slamming on the square peg to get it in the round hole over and over again until the hammer breaks.

There are countless more examples. Raising taxes raises progressively less revenue, so consequently, you raise taxes even more. You keep doing what doesn’t work, even if it doesn’t work.

This is allegedly an Einstein quote: “The definition of insanity is doing the same thing over and over again and expecting a different result.”

The problem is, there are no controlled experiments in finance. Japan will never know how things would have worked out without Abenomics. Publicly, they will say it would have been worse. But there is no way to know!

After all, see how Depression-era history is taught in the United States. The New Deal saved the world. What if we didn’t have the New Deal? Maybe things would have been better? After all, the crash happened in 1929 and the economy didn’t recover until 1946. Warren Harding’s response to the (very severe) recession of 1921 was to do nothing, and the economy recovered in less than two years.

Interventionism is always praised after the fact. Nobody ever says doing nothing did something.

So the second aspect of this is that policymakers need to be seen doing something. They can’t be seen doing nothing, because that would mean they are not doing their job, even if their job might be staying out of the way. The concept of laissez-faire seems pretty quaint nowadays.

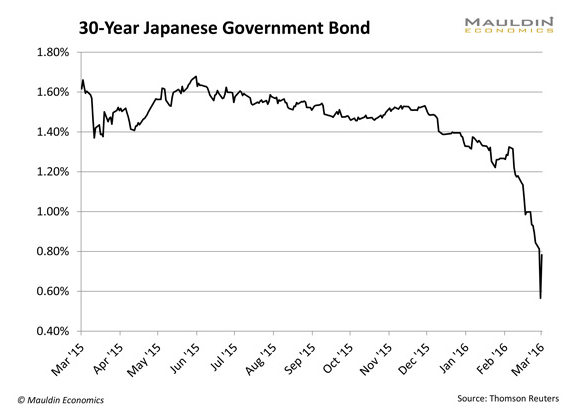

Japan is dealing with some pretty serious consequences of its interventionism. JGB yields dropped 25 basis points in a day, flattening the yield curve and rendering the banks possibly insolvent (and then went back up 24 hours later).