The world’s largest money manager is not alone in this thinking. European policymakers have arguably led the march to incorporate rules around climate, but the United States is quickly following suit. The Biden administration has made climate risk and ESG top priorities, not just in social arenas, but in financial ones. For example, Treasury Secretary Janet Yellen has pledged to put together a team to look at financial system risks arising from climate change, which she refers to as an “existential threat.”

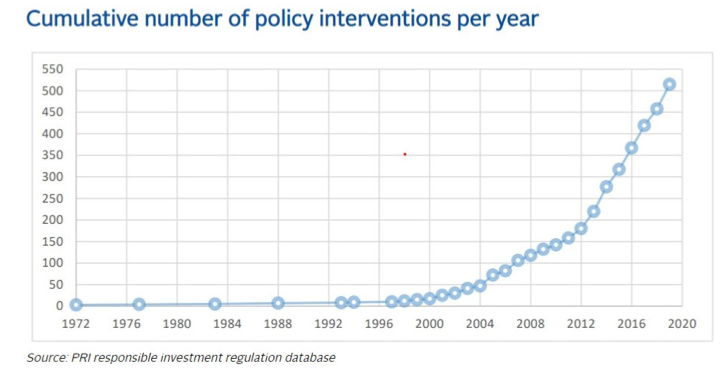

The Principles for Responsible Investment, an international network of investors working to understand and incorporate ESG, tracks regulations around long-term value drivers such as ESG. Its 2019 update showcases the tremendous increase in these types of policy interventions.

Investors seem to be listening. Interest in ESG investing has increased dramatically over the last several years, and it’s not just the purview of pensions and endowments anymore.

Sustainable funds pulled in $51.1 billion in net flows in 2020, more than doubling the record set the year before, according to Morningstar. Fund flows into these products accounted for nearly one fourth of overall flows into funds in the United States (Source: Morningstar “Sustainable Funds U.S. Landscape Report,” 2020).

So, what is the net takeaway on performance expectations for socially responsible investments, given that this umbrella now includes and is increasingly focused on ESG? Thousands of studies have tried to answer this question. But the truth is that, for the individual advisor or investor putting together a portfolio, there is no correct sweeping answer, particularly since these investments can vary dramatically. More sophisticated approaches—oftentimes not just excluding unwanted companies, but more carefully integrating ESG themes to under and overweight within sectors—can minimize tracking error, making it possible to invest in ESG without betting the farm. On the other hand, thematic investments can feature concentrated bets on specific aspects of ESG that an investor may believe is poised for outperformance, say water scarcity or board diversity.

The track record on these newer investments is just not long enough to be able to judge empirically. Early evidence is positive, with ESG funds performing particularly well in 2020 and demonstrating risk-reduction potential. Deutsche conducted a meta study, published in 2015, combining the results of about 2,200 studies on ESG and corporate financial performance going back to the 1970s. About 90% showed non-negative relationships, with the majority finding a positive relationship, though portfolio studies were less positive, suggesting that investors in these companies via vehicles like mutual funds had not necessarily earned this outperformance (Source: Gunnar Friede et al. “ESG and financial performance: Aggregated evidence from more than 2,000 empirical studies,” Journal of Sustainable Finance & Investment, October 2015, Volume 5, Number 4, pp.210-33, Deutsche Asset & Wealth Management Investment). More recently the NYU Stern Center for Sustainable Business and Rockefeller Asset Management announced findings from a meta-study focused on 1000 papers on ESG done in the last five years. Among the findings was that sustainability initiatives appear to lead to improved risk management and greater innovation (Source: Whelan, Tensie, Ulrich Atz, Tracy Van Holt and Casey Clark. “ESG and Financial Performance: Uncovering the Relationship by Aggregating Evidence from 1000 Plus Studies Published between 2015 -2020.” Rockefeller Asset Management and NYU Stern Center for Sustainable Business.).

Governance themes in particular seem correlated with quality measurements, a style factor anomaly that has long been associated with positive return and reduced risk. In 2019, MSCI published its own meta study and found “significant evidence that the application of MSCI ESG Ratings may have helped reduce systematic and stock-specific tail risks in investment portfolios.” (Source: Giese, Guido and Linda-Elling Lee, “Weighing The Evidence: ESG and Equity Returns,” MSCI, April 2019.) MSCI has also begun looking at ESG as its own factor, and early evidence is that its efficacy in explaining stock-specific risk is increasing, possibly due to increased firm investment in sustainability-related measures (Source: Factoring in ESG,” MSCI, Feb. 26, 2021).

Is recent outperformance the reason money is piling into these investments? Maybe. There’s a shorter-term aspect to the alpha thesis that might also be driving such interest, namely, the desire to ride the wave up. Many believe that at some point, there really is no ESG investing, as these considerations become incorporated across investing in the same way any other risk consideration is analyzed. In the meantime, as investor preferences for these stocks drive their prices up, investor returns will likely be positive as prices rise to a new equilibrium. So, maybe all we have to believe today is that interest in ESG will continue to increase.

Dana D’Auria, CFA, is co-chief investment officer at Envestnet.