3. Data and Technology: For both operational efficiency and responsive client experience, firms must accelerate their digital/data strategies and enabling technology systems. Despite a strong focus on transformation in data and technology, only 15% of those surveyed feel very prepared to address digital capabilities. To improve client experience and operational efficiency, firms must move away from vertically siloed legacy technology systems toward matrixed, connected systems that facilitate the exchange of data and enable more seamless client interactions.

Data and technology must run horizontal across all client touchpoints. A pertinent example: At one firm, a new robo-advisor was implemented to help service and manage mass affluent clients. Before implementation, an analysis was completed that identified 141 potential client touchpoints across four distinct service streams, involving 70+ stakeholders. Once the firm mapped it out, decision-makers realized its people would not be able to handle everything required to be successful. Based on this analysis, they factored in new technologies and data strategies that would be needed to create efficiencies and an exceptional client experience.

Strategies To Get Horizonal

1. Prioritize client experience investments for maximum business and client value. As financial services firms strive to become more client-centric, investments in CX should be backed by a strong financial business case.

2. Transform the way work gets done to drive efficiency and activate the client experience. Apply an end-to-end framework for diagnosing, solving and implementing improvements to the client journey. By first mapping all the physical and digital interaction points with clients, firms can align people, processes and technology to deliver a reimagined experience while increasing efficiency.

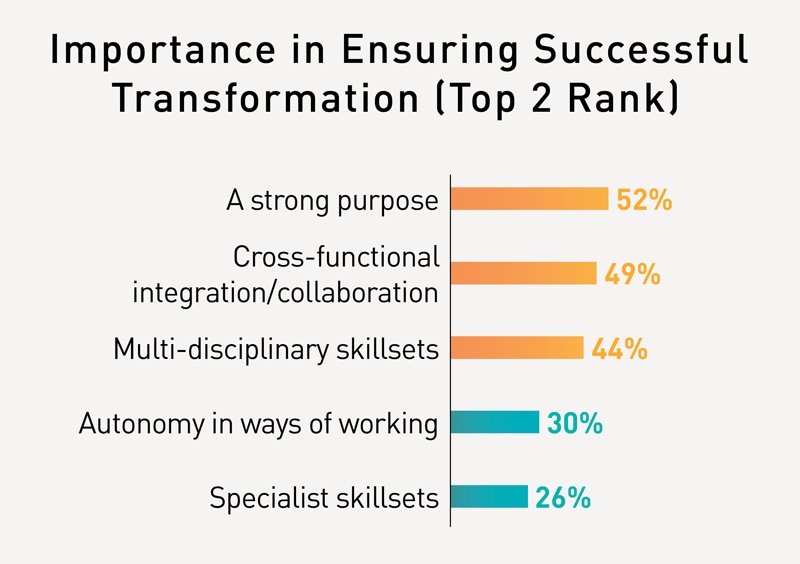

3. Accelerate the adoption of change. Focus on attracting and retaining strong, multi-disciplinary leaders to drive client-centric change throughout a matrixed organization.

4. Take technology out of the IT silo. Determine the data and technology solutions that optimize processes, manage costs and help enable an improved client experience. Specifically, automation technologies can help increase employee engagement by moving people toward higher-value work and freeing up time for them to focus on enhanced customer interactions.

By investing in disruptive technology, optimizing processes and focusing on people, firms will be better prepared to address today’s priorities, while building resilience and adaptability to keep pace with clients’ evolving demands. As seismic disruptions emerge in the years to come, those who have gone horizontal will stand strong.

Jill Jacques is global financial services lead for North Highland, a management consulting firm.