At this year’s Inside ETFs Conference, I participated in a panel called "Everything You Need to Know: The Thematic Crystal Ball" that covered a range of topics related to thematic investing including top themes for 2019, what makes a good theme, why investors should consider thematic investing and more.

During the Q&A portion of the panel, we unfortunately ran out of time before addressing an important question that I was eager to discuss with my fellow panelists: "Should thematic ETFs be equal weighted or market cap weighted?" In the piece below, I share Global X’s perspective on weighting thematic ETFs, and welcome the debate with fellow panelists that unfortunately didn’t happen on stage.

Constructing a portfolio of securities ultimately comes down two major decisions: 1) What should I own (selection); and 2) How much should I own (weighting). These two questions are unavoidable whether investing in themes, factors, sectors or broad asset classes. Beneath these two overarching questions there are multiple detailed sub-questions such as rebalance and reconstitution frequency, IPO and corporate action treatments, and so on. Ultimately, these roll up under the overarching questions of what to own and how much.

It’s safe to say that most investors likely focus more attention on selection than weighting scheme. The decision to own U.S. large cap or emerging-market small caps is likely debated longer in investment committees than whether broad U.S. equities exposure should be market cap-weighted or equal weighted. Yet weighting scheme should not be ignored because it is a key contributor to both risk and returns.

Over the past 10 years, for example, the S&P 500 Equal Weight Index has had annualized returns of 18.84% with a volatility of 15.09% compared to 16.67% annualized returns and volatility of 12.90% for the regular market cap-weighted S&P 500 Index. Owning the same 500 stocks with a different weighting scheme added 2.17% more annual returns, with 2.19% higher risk, which is a meaningful difference over 10 years.

When developing a thematic ETF and working with an index provider to create the index methodology, the same key questions apply: what securities should be selected and how much weight should be in each security. On the selection front, our product team spends months during the R&D phase "defining" a new theme like robotics and AI, for example, and translating it into a rules-based process to identify key companies in the space.

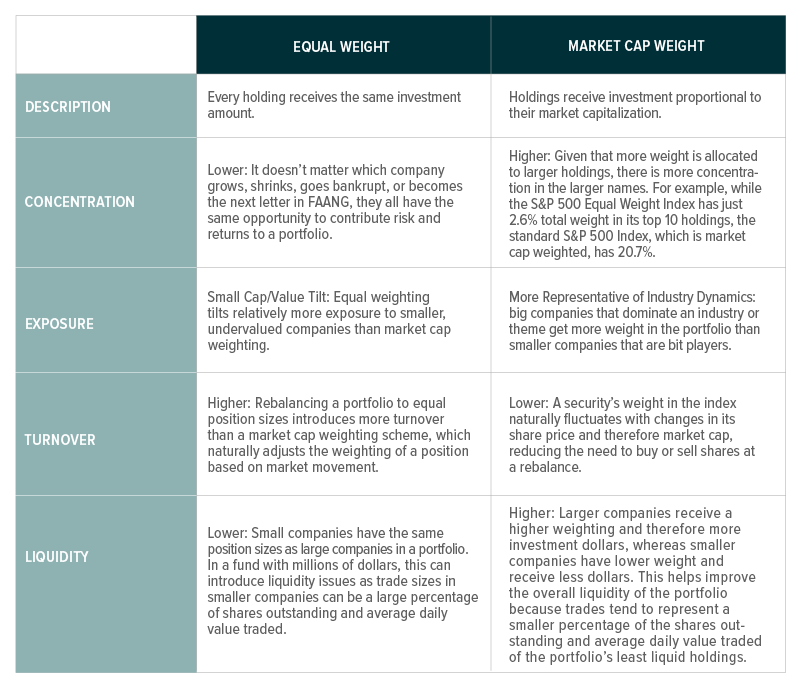

But also significant is the decision of which weighting scheme to apply to those companies. While there are infinite approaches to weight a basket of securities, we most frequently encounter two approaches in thematic ETFs: equal weighting and market-cap weighting. Below is a brief discussion of the characteristics of both approaches.

Which Do We Choose?

While there are trade-offs with both approaches, at Global X our thematic growth ETFs follow a market cap-weighted approach that contrasts with many thematic ETFs in the market that opt for equal weight-based approaches.