With demand waning and supplies increasing, the housing market is in for a lot of pain. Low interest rates have been a boon to housing, making mortgages more affordable and allowing consumers to refinance existing loans, with many of them tapping the equity in their homes for extra cash. In the third quarter of 2021, loans for refinancing totaled $512 billion, compared with $442 billion for purchases.

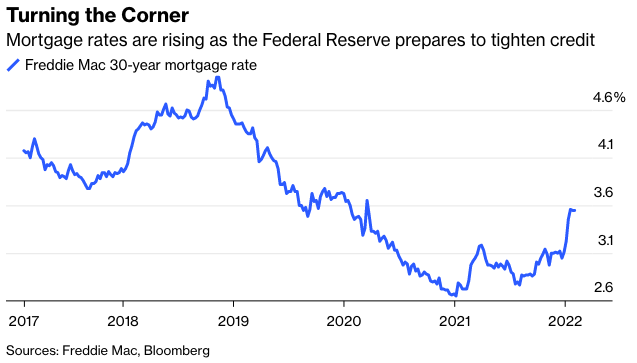

But the Federal Reserve is tightening monetary policy, and rates on 30-year fixed-rate mortgages have already risen from 2.82% in February 2021 to a recent 3.84%. Also, the spread between those mortgage rates and yields on 10-year U.S. Treasuries to which they are linked has risen from 1.4 percentage points in May to 1.9 percentage points, suggesting that mortgage rates will continue to rise faster than Treasury yields. Furthermore, the central bank was a massive buyer of mortgage-backed securities, purchasing some $2.7 trillion during the last cycle, or 23% of the amount outstanding. As it concludes those purchases in March and then, very likely, begins to sell what it holds, the negative effects on the mortgage market will be much greater than past Fed tightenings.

No wonder that a survey released by Fannie Mae this week showed that the share of Americans who think it’s a good time to buy a house fell to an all-time low of 25% in January. The high probability of a Fed-precipitated recession is also a major negative for single-family housing. The central bank doesn’t intend to touch off business downturns when it tightens credit, but in 11 of the 12 times in raised its main policy rate since the early 1950s, a recession followed. The only soft landing was in the early 1990s. The challenge of ending purchases of Treasuries and mortgage-backed securities and reducing its balance-sheet assets this time only raises the likelihood of a recession. If the Fed dumps mortgage-related securities on the market, the increased supply will reduce demand for new issues by banks and other institutional buyers, further raising borrowing costs.

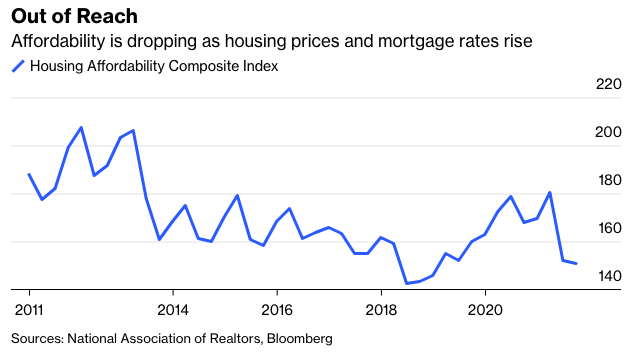

Meanwhile, monthly rents jumped more than 14% in December from a year earlier, according to Redfin. This has made homeownership more attractive but also reduced funds available for down payments just as bigger down payments are needed to compete with the plethora of all-cash buyers. Last month, the median single-family house price jumped 14% to $357,000 from a year earlier, according to Redfin. The median-priced house leaped from 4.2 times median household income in the first quarter of 2019 to 5.6 times median in the fourth quarter of 2021, exceeding the previous record high of 5 times during the fourth quarter of 2005 when the subprime mortgage bubble was in full swing. The National Association of Realtors’ housing affordability index dropped from 180 in the first quarter of 2021 to 151 in the third quarter.

In response, the University of Michigan’s index of buying conditions for houses plunged from 143 in January 2020 to 63 in November. The Mortgage Bankers Association index of mortgage applications dropped from 348 in January 2021 to 227 in December. New home sales, which jumped from a 649,000 annual rate in October to 811,000 in December, will no doubt drop in future months. Ditto for existing home purchases, which rose from a 5.88 million annual rate in August to 6.18 million in December. Furthermore, the pandemic-inspired stampede from small, expensive urban apartments to more spacious single-family houses in suburbs and rural areas appears to have peaked. As the economy reopens, the desirability of home offices and classrooms is no longer growing and many, especially millennials, are returning to big-city apartments.