In a recent interview with CNBC, a reporter asked us why Berkshire Hathaway (BRK) was buying Barrick Gold common stock shares. As a high school and college student in the 1970s, my education was formed during a time of explosive inflation and included the economic problems that came with consistently rising prices. Although that was long ago, after the interview, I decided to look up the definition of inflation to remind myself. We found this classic definition on August 17, 2020:

Inflation: A persistent increase in the level of consumer prices or a persistent decline in the purchasing power of money, caused by an increase in available currency and credit beyond the proportion of available goods and services.

What kind of cocktail got mixed in the 1960s and 1970s to meet this classic definition of inflation? What kind of cocktail must be mixed today to get us into this classic definition of inflation over the coming decade? What are the investment implications of entering a new era of rising prices, decreased purchasing power and goods shortages?

In the 1960s, the U.S. Government tried to do two things at once. They fought a war halfway around the world, which was incredibly expensive (Vietnam War). Simultaneously, we attempted to improve the lot of the nation’s least fortunate through what President Lyndon Johnson called the “Great Society.” Both were massive expansions in government spending, which required the U.S. to issue bonds and print money.

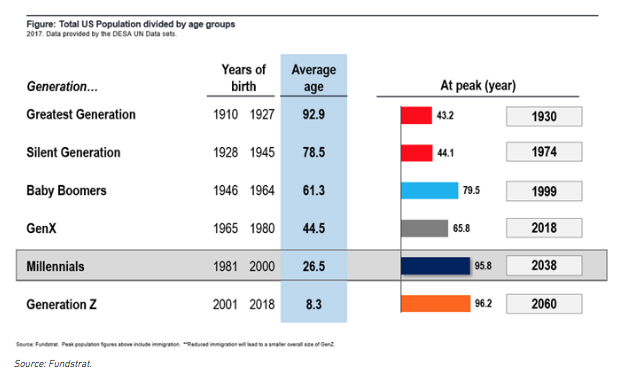

During the 1960s and 1970s, demographics put the U.S. in population circumstances, which caused goods and services to be in short supply. Oil was cheap in the 1960s, until 79 million baby-boomers replaced 44 million silent generation folks in the 20-35-year age cohort. Waves and waves of 16-year-old Americans got their driver’s licenses. If you want to understand that era, watch the movie American Graffiti.

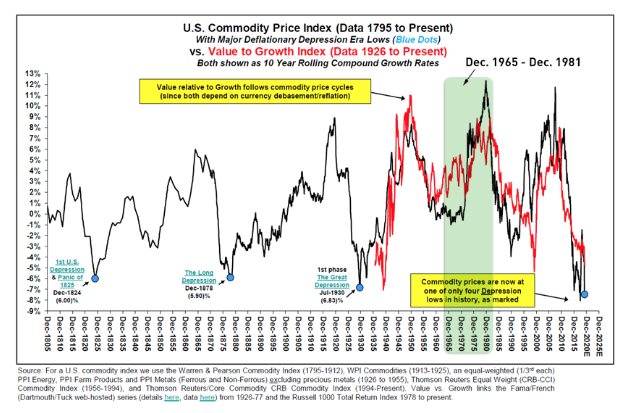

Oil soared in price from $4 per barrel in the 1960s to $40 in 1981. Gold went up from $35 per ounce to $595 from 1965 to 1981. The chart below does a great job of showing what commodity prices did in the 1960s and 1970s:

The U.S. Government is now fighting the war against Covid-19 and frighteningly high unemployment levels. We have thrown $4 trillion at this war already and we aren’t done yet. Gold is responding like it did in the 1960s and 1970s and was affirmed recently when it was reported that Berkshire bought a chunk of Barrick Gold shares. Oil bottomed when the Saudi Arabians led an effort to use the Covid-19 misery to crush U.S. oil production. This sets up the kind of limited supply the classic definition of inflation requires in its cocktail.

The demographics are perfect for more inflation this time as well. There are 90 million Americans between 23 and 41 years of age. They are forming households later in life than prior generations but are coming out of the woodwork to buy germ-free brand-new homes and are causing home prices, lumber and used car prices to explode to the upside. These millennials are replacing 65 million Gen X folks. When 36% more 30-45-year-old people buy houses and cars, they’ll use more gasoline the next 10 years.