After months of steady increases, negative-yielding debt has skyrocketed to new all-time highs, currently standing at close to $16 trillion globally. At the same time, an increase in global risk aversion driven by weaker-than-expected economic data and general uncertainty has driven the spread between U.S. 2-year and 10-year yields to invert (albeit briefly for now).

As the predictions for yield curve steepening are proved either wrong or premature, so are those calls for a rotation to value stocks from growth stocks. As such, we continue to favor growth stocks even as their performance may be negatively impacted by macro headlines in the short-term.

What We’ve Seen

THE U.S. YIELD CURVE HAS INVERTED

• As longer-term rates have declined, the U.S. 2-year/10-year Treasury yield curve is touching levels last seen in 2007. Another measure of the curve looking at 3-month yields on the short end first inverted in May. This has prompted many investors to rekindle concerns that the likelihood of a U.S. recession could occur in the next 12 to 18 months.

• Using daily data during yield curve inversions that began in 1989, 1998 and 2006, we found that growth outperforms value on average both heading into and after inversions, furthering our case for growth stocks continuing to be attractive on a relative basis.

Source: Bloomberg Finance, L.P., as of August 13, 2019. Past performance is not indicative of future returns. One cannot invest in an index.

Money in Motion

Through the early part of this year’s second half, both growth and value ETFs are seeing outflows as investors take chips off the table, with growth outflows exceeding $1.14 billion and value at close to $600 million.

• Putting that into context, this year’s first half saw ETF investors pile into growth while redeeming assets from value, resulting in a spread greater than $6 billion as investors may have finally capitulated considering that value ETFs took in $27.3 billion more than growth did in the previous three years.

• Included in the dataset below, value ETFs have seen greater flows in over 75% of the full semi-annual periods highlighting how consistent flows were over this time period as investors likely still remain long and wrong when it comes to relative positioning. However, many of these flows may be contrarian in nature, so we may not see outflows equaling the inflows.

ETF INVESTORS PUSH PAUSE ON GROWTH AND VALUE ETFs

Source: Bloomberg Finance, L.P., as of August 13, 2019. Data represents the semi-annual net flows of U.S.-listed U.S. Large Cap Growth ETFs and U.S. Large Cap Value ETFs, specifically targeting exposure to U.S. Large Cap Growth and Value stocks, respectively.

What’s Next?

• While growth stocks may suffer as investors weigh what impact the continuing global slowdown will have on earnings, we caution investors not to view value stocks as a defensive alternative even if they see short-term outperformance.

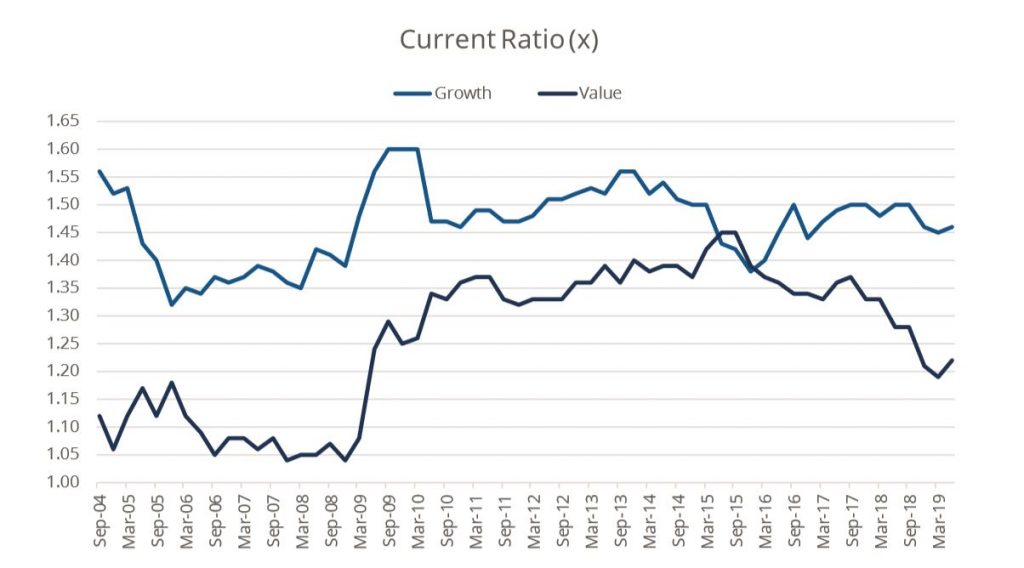

• Along with other quality metrics, one measure that investors may want to consider is that the current ratio of the growth cohort has been relatively stable in the recent past, while value stocks have seen their ability to cover short-term obligations deteriorate. While this time may be different, the fact is that an inverted yield curve has preceded each of the last seven recessions. If the FOMC lowers administered rates at the September meeting to a greater extent than they signaled at the July meeting when emphasized the need for insurance as opposed to the start of a new cutting cycle for the time being, they may already be behind the curve.

• Investors should look to the upcoming Jackson Hole Economic Policy Symposium on August 22 to 24, aptly named “Challenges for Monetary Policy,” for insights into what the next move may be and in the meantime tune out tweets.

THE CURRENT RATIO OF GROWTH STOCKS BESTS THAT OF VALUE

Source: Bloomberg Finance, L.P., as of June 30, 2019. Growth represented by the Russell 1000 Growth Index and Value represented by the Russell 1000 Value Index. One cannot invest directly in an index.

— David Mazza is managing director and head of product at ETF provider Direxion.