With the financial crisis of 2007-2009 still very visible in many-an-investor’s rear view mirror, factor investing is rapidly emerging as an alternative to the diversification strategies that clearly failed to protect certain assets during the market meltdown. Advisors are being called upon to explain to their clients how factor strategies work, whether to implement them into portfolios and how to do so while seeking to avoid potential hazards. Investors considering factor-based, or smart beta, strategies therefore need to do their homework.

Factor investing may be best understood as a more granular look at diversification and correlation than the classic model of allocating across asset classes. Each asset class carries elements of risk and of return, and factors such as value, quality, volatility and momentum are the characteristics that can offer explanation to both risk and return.

By approaching portfolio construction from the perspective of determining the right mix of investment factors, rather than relying only on asset classes, factor investing can result in a more efficient portfolio. The low volatility factor, for example, will likely to do well in different market environments than the momentum or value factor.

Hard-Coded Methodology to Stay on Mandate

A significant body of academic research has looked at the characteristics of various factor exposures over long periods of time, across market cycles and regions, and has shown that certain factors are indeed rewarded. Although, based on historical research, these investment factors are expected to generate excess returns or outperform market-cap-based benchmarks over market cycles, they are influenced by the macro environment and market conditions over shorter time horizons.

Research (and our own experience as investors!) has shown that performance is cyclical and factors can underperform over periods of time. Additionally, individual securities as well as portfolio returns are driven by multiple factors, and the impact of exposure to these factors can vary.

For example, a low volatility strategy may periodically benefit from momentum during periods of strong excess return. Similarly, a value strategy may periodically benefit from the size factor during periods of strong excess return. Since we don’t operate in a one-dimensional world, it is important that single-factor strategies seek to target exposure in a simple, systematic and unconstrained way.

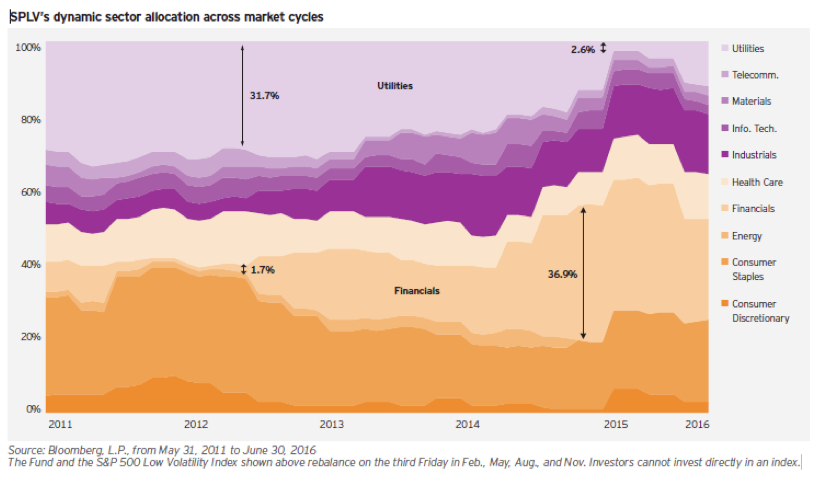

To take one example, SPLV—as shown in the figure above—is designed to rebalance between sectors in order to provide pure exposure to the low volatility factor by investing in the 100 stocks in the S&P 500 Index with the lowest volatility over the last year, regardless of sector membership. The strategy is rebalanced quarterly so that it regularly reallocates to the securities that have demonstrated the lowest volatility.

Advisors looking to compare factor-based strategies should carefully examine the methodology that underpins them. How does the portfolio come together? What original universe is it pulling its constituents from? What metric or metrics does it use to target the intended factor exposure? How diversified is the factor exposure? How often is it rebalanced? And is the portfolio constrained such that it is forced to match certain characteristics of a parent index, or is it unconstrained so it can provide more targeted factor exposure?