“Every age has its peculiar folly; some scheme, project, or phantasy into which it plunges, spurred on either by the love of gain, the necessity of excitement, or the mere force of imitation.

Failing in these, it has some madness, to which it is goaded by political or religious causes, or both combined.”

—“Extraordinary Popular Delusions and the Madness of Crowds,” Charles Mackay

“When the going gets weird, the weird turn pro.”

— “Fear and Loathing in Las Vegas,” Hunter Thompson

The year 2021 will be remembered as one in which markets tumbled down a rabbit hole and entered financial wonderland: A once-elite undertaking became more populist, tribal, anarchic and often downright bizarre.

Retail investors upstaged hedge funds, crypto squared up against fiat currencies and financial flows crushed fundamentals. Farewell stocks, hello “stonks”: Memes matter now.

Here’s a taste of the madness: Entrepreneur and social media puppet master Elon Musk became the world’s wealthiest person. Tesla Inc.’s market capitalization exceeded $1.2 trillion, more than the next nine largest automakers combined.

One of those others, Rivian Automotive Inc., went public in November and only recently started generating revenue. It was soon valued at $150 billion.

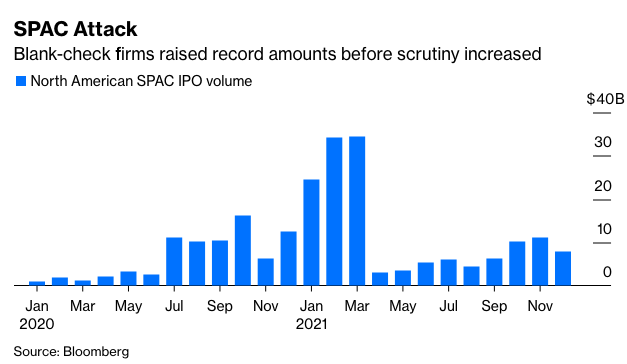

Hundreds of special purpose acquisition companies, or SPACs, together raised more than $150 billion to find a company to list on the stock exchange, with their targets often more of a business plan than a business.

Cryptocurrencies, the bulk of which have no intrinsic value, were at one point collectively worth more than $3 trillion. A non-fungible token artwork (NFT) — in this case, a JPG file by an artist named Beeple — sold at a Christie’s auction for $69 million.

Struggling video games retailer GameStop Corp. and cinema chain AMC Entertainment Holdings Inc. soared as much as 2,450% and 3,300%, respectively, when Redditors coordinated online to punish hedge funds that were betting on the companies’ demise. (Intraday peak compared to the start of 2021.)

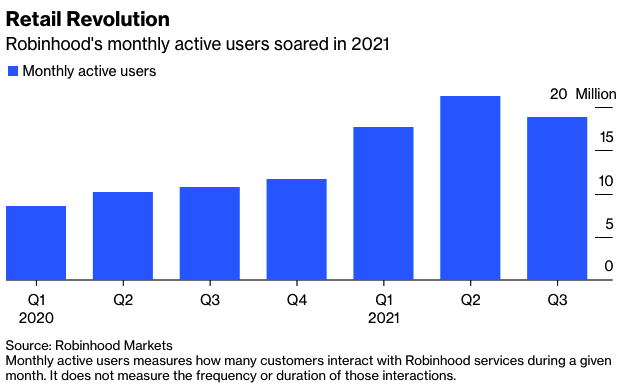

And because there’s no gold rush without pickaxes, retail brokerage Robinhood Markets Inc. and crypto exchange Coinbase Global Inc. became two of the year’s biggest initial public offerings: At the peak they were valued at $59 billion and $75 billion. (In December the home of WallStreetBets, Reddit Inc, announced it had filed confidentially for an IPO)