The upward trend in prices, then, is also likely to keep going for a while. This is a potential threat to the economy and financial markets. The question is, what will signal that the risk is becoming not only real but also imminent?

How To Spot Imminent Risk

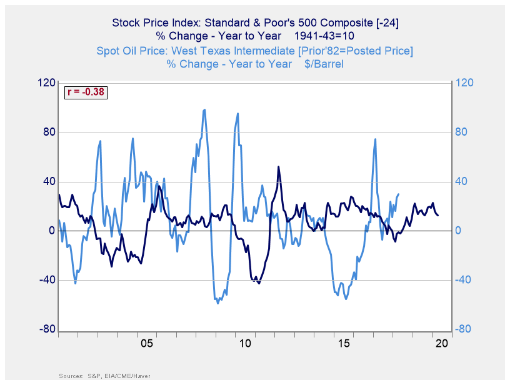

From an economic standpoint, the best way to spot imminent risk is when the price change rises above 80 percent, year-on-year. This has been a reliable signal of past recessions. So, for the moment, we are not close to the danger zone. We can tell, though, that with oil prices a year ago around $45 to $50 per barrel, the trouble zone is around $80 to $85 per barrel. If oil prices here in the United States get to that range, and stay there, it will be time to start looking for the economic risks to get much more serious.

For the financial markets, the situation is more complicated. While higher oil prices have a negative effect on the economy at a certain point, that takes time to kick in. In the meantime, energy companies are making more money, which can be positive for the market as a whole. In theory, that would mean oil price spikes would lead to a market pullback some time later.

In fact, that is exactly what happens, as you can see from the chart above, with about a two-year lag. Correlation is not causation, of course. But this makes theoretical sense, as well as being empirically correct. So, it is something we need to watch.

Where Does This Leave Us?

There is no immediate concern, as price increases are still below the trouble zone. But we should watch for a target of $80 to $85 per barrel as a worry point. Once we get there, on a sustained basis, we then have a year or so before that starts to knock the market.

Of course, none of this is guaranteed. But it provides us with a structure to think about recent events and to plan for future outcomes. Short-term events might affect the price of oil, but it is the long-term trends that will ultimately drive economic and market risks. Those trends are indeed moving in the wrong direction, but the warning lights are not flashing yet.

Brad McMillan is the chief investment officer at Commonwealth Financial Network, the nation’s largest privately held independent broker/dealer-RIA. He is the primary spokesperson for Commonwealth’s investment divisions. This post originally appeared on The Independent Market Observer, a daily blog authored by Brad McMillan.