For the second consecutive year, RIAs are enjoying record assets under management and revenue, according to Charles Schwab's 2012 RIA Benchmarking Study. Revenues at the median firm in our study of more than 1,000 advisories grew by 12% in 2011 to $1.38 million, while median assets under management were up 4% to end 2011 at $201 million. Those levels are extraordinary when you consider firms reported a recent low in revenues of $1 million in 2009 and a median $134 million in assets under management at year-end 2008. Increased revenues and assets have given RIAs more resources to explore their future direction-to find out whom they want to serve and figure out how to best structure their businesses to grow rapidly and profitably.

The growth and evolution of the registered investment advisory field has been an amazing thing to watch and participate in. The first few waves of RIAs blazed a trail with little support, resources or even a clear map of where they were headed. But these pioneers saw that independence would allow them to serve clients without restrictions or conflicts and created the industry from the ground up.

What's most exciting to me is that we're still in the early stages of our industry's development. RIAs today have both an amazing opportunity, and an important responsibility, to think about who they want to be in the future and where they want to take their businesses to achieve even higher levels of trust, credibility, respect and success.

The RIA Marketplace

In planning the future of their firms, it's important that advisors look not just at their own internal business practices but also at the changes and trends occurring in the larger RIA universe. The marketplace continues to expand-and as it does, advisors are presented with a range of new opportunities about how to structure their businesses and serve clients. Consider these important dynamics we're seeing in the industry today:

More advisors are transitioning to independence. This is no surprise. More brokers, seeing the success of peers striking out on their own, are looking to join them. In a Schwab survey of advisors at major financial firms, more than 76% expect a continued increase in the number of advisors moving to the RIA model, and 51% say they find the idea of being an RIA appealing.1 And a virtuous circle is developing: As more RIAs emerge, there will be more resources and options for them-which in turn encourages more brokers to go independent.

More capital is flowing into the RIA space. The RIA model allows advisors to create long-term value in their firms, unlike their peers in the wirehouse. But access to capital is necessary, and as the RIA space has grown, it has caught the attention-and money-of venture capital firms, large consolidators and even other RIAs looking to grow through acquisition.

This flow of capital is breaking down the industry's barriers to entry, making it easier for advisors to get up and running, and giving new advisors more choices for building and structuring their practices. It's also helping RIAs with succession plans, allowing principals nearing retirement to give junior advisors ownership stakes in their companies.

There are more third-party providers. As the ranks of independents have grown, so have the number of product and service providers supporting them. Firms such as turnkey asset management providers (TAMPs), for instance, offer key functions like reporting, research and product packaging under one umbrella.

Advisors need this kind of operational support. Many of them feel client service and operations obstacles stand in the way of growth (about 47% of firms named these things as barriers in the benchmarking study, up slightly from last year). One in five firms said their No. 1 initiative for 2012 was related to "client service and operations," and 65% had such an initiative in their top three initiatives. Additionally, 23% of firms had "investing in new technology to support productivity" among their top three initiatives.

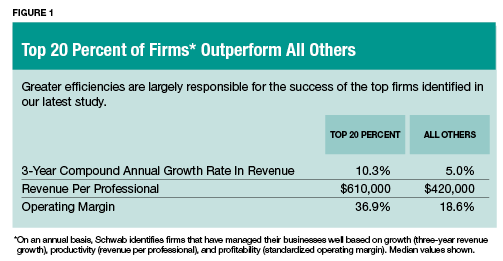

The firms in our study are highly engaged and productive but they want to become highly efficient as well. To that end, they are focusing on work flow within their offices so that everyone is working efficiently and eliminating errors, and augmenting these smarter work flows with technology such as integrated CRM systems. Third-party vendors can help them do this.