Increasingly, even long marriages are at risk. “Among all adults 50 and older who divorced in the past year, about a third (34%) had been in their prior marriage for at least 30 years, including about one in 10 (12%) who had been married for 40 years or more,” says a 2017 Pew Research Center report. “Research indicates that many later-life divorcées have grown unsatisfied with their marriages over the years and are seeking opportunities to pursue their own interests and independence for the remaining years of their lives.”

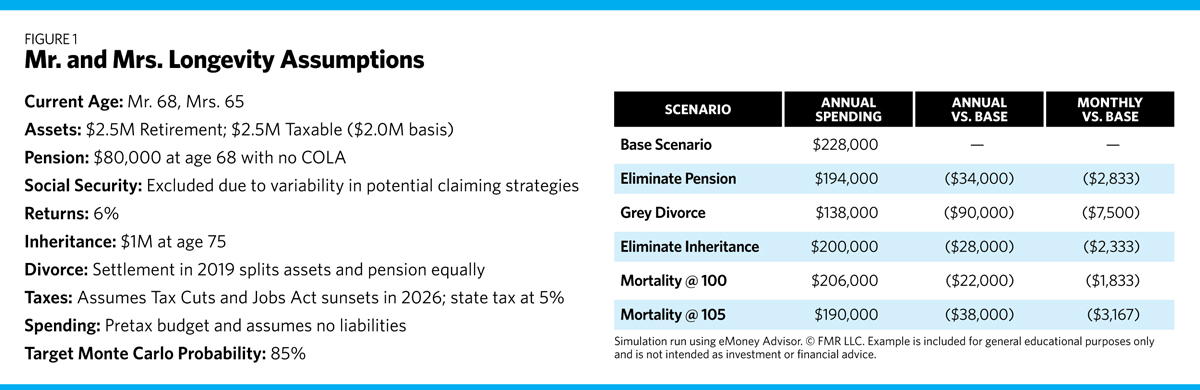

It seems reasonable that as people live longer, we’re likely to see even more couples deciding to split much later in life, possibly during their retirement years. Consider a couple who carefully save for retirement, transition to a long-imagined lifestyle and then decide to part ways. If years of financial decisions such as retirement timing, asset titling and spending budgets have been established during a long marriage, a grey divorce can upend even the most prudent retirement planning decisions.

Those divorcing late in life may also likely find new spouses, and that creates planning challenges for those wanting to protect assets and create estate plans that balance the new spouse’s needs with those of existing heirs. If the new spouse is younger, the couple will likely need a larger asset base to offer a longer period of cash flow and portfolio longevity. This challenge is compounded when assets or income sources have been partially dissipated in a divorce. At a minimum, advisors should provide detailed analyses of potential retirement spending early in the new relationship. That way, both parties are clear about the financial, lifestyle and potential estate plan implications of taking on a new spouse.

Analyzing Potential Delays Or Dissipation Of Inheritances

Clients can also be affected by the greater longevity of their parents and the effect that has on the transition of family wealth. Inheritances may be delayed or assets may be dissipated if aging parents incur significant health-care costs. Or parents may simply live longer, which could delay heirs’ access to the assets. Owners of lucrative family businesses may elect to stay in the businesses longer, deferring transfer of income production or the ultimate wealth transfer to heirs.

For those baby boomers anticipating for years that an inheritance will cover their own longevity risk, a delay or loss of inheritance could be a rude awakening. While it’s difficult to quantify, parents’ prospects of living a longer life may reduce the likelihood that they will, while still alive, make significant gifts to their children. Imagine the potential impact on their retirement lifestyle if the announcement of lower lifetime gifts, or reduced or eliminated inheritance, comes later in clients’ life cycles—when it may be too late to replace the lost inflow of those expected assets.

Potential Responses

One way for retirees to manage their longevity risk is to turn to insurance products, which allow users to share that risk with an insurance company. This topic warrants an article all its own, so suffice it to say that products like hybrid long-term-care policies are just one example of a range of products aimed at off-loading some longevity risk. Insurance products may also be helpful tools in grey divorces to provide for newly single women or for prenuptial arrangements or to provide assets for children or a new spouse.