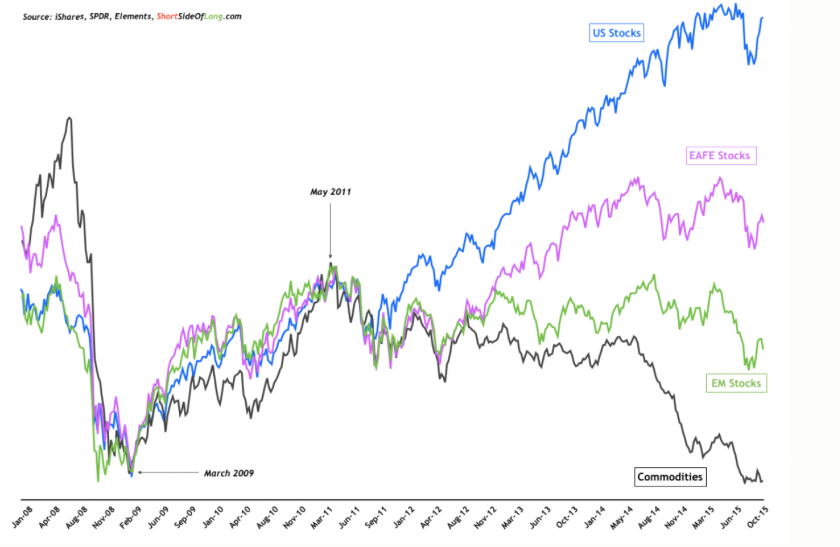

The stage for this type of volatility was set in the last three years, as very large gaps opened between the performances of various regional or sectoral financial markets.

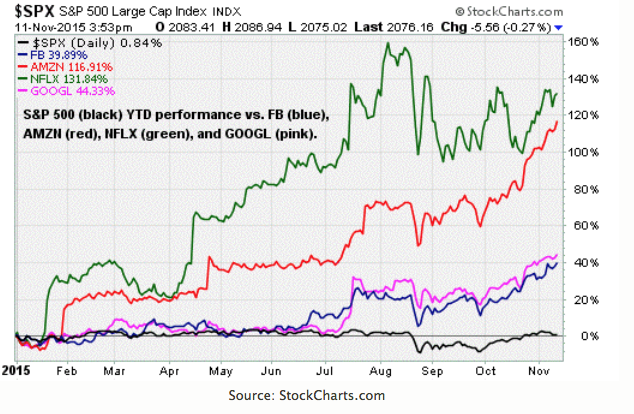

Within the U.S. stock market, similar gaps have developed. The four so-called “FANG” stocks (Facebook, Amazon, Netflix and Google) and the “Nifty Nine”, which also includes Priceline, eBay, Starbucks, Microsoft and Salesforce, rose strongly in 2015, while the majority of other stocks were down (energy, materials and manufacturing) or broadly unchanged for the year.

The kind of financial divergences that have opened in the last three years are usually closed, eventually, and the volatility promised by the lack of economic visibility could portend a challenging coming year for the financial markets.

Francois Sicart is the founder and chairman of Tocqueville Asset Management.