A spate of foreclosures intensified the damage from the last recession. Measures like forbearance show that policymakers have learned from that experience. But these steps don’t eliminate the stress, they just shift it. The U.S. mortgage industry may once again require reinforcement.

Blame It On Rio

Initially, epidemiologists had hoped that warm-weather countries would not be deeply touched by the coronavirus. But with around 180,000 confirmed cases and over 12,000 COVID-related deaths, Brazil is staring at a full-blown health emergency and is at risk of an economic meltdown.

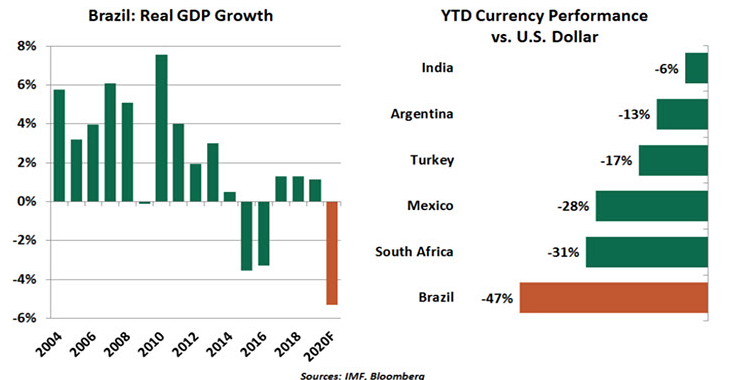

Though Brazil’s mortality rate is lower than that of many advanced and emerging economies, the density of its population and the weakness of its medical system create significant problems for public health. The country’s economic health is also in question: growth has failed to reach the dynamic levels seen early in the last decade, when Chinese demand for commodities made Brazil an emerging star. Falling mineral and crop prices and inadequate infrastructure have taken a severe toll on activity and confidence in Brazil.

Today, the country is facing a severe recession as a result of the virus’s spread and lower commodity prices. Incomes have been ravaged. The Brazilian real (BRL) has fallen to record lows against the dollar and is the worst performing currency of 2020. Even before the outbreak, Brazilian markets were already in a furrow and are currently down 33% on a year-to-date basis. Risks for the financial sector are rising as proposals (including limiting credit card and overdraft interest rates) against financial institutions are gaining momentum.

The Brazilian government has announced fiscal measures equivalent to 7% of gross domestic product (GDP) in the form of direct cash transfers, tax deferrals, expansion of social safety nets and credit lines to small and medium-sized enterprises. The central bank is doing its bit as well, slashing overnight rates by 150 basis points to a record low of 3.0% this year, with more likely to come. With a fiscal deficit of about 6% of GDP and government debt around 80% of GDP, the economy is in a precarious state. Large-scale measures would revive concerns about Brazil’s fiscal position, something that policymakers were hoping to have put to rest with last year’s pension reforms.

The administration’s lax attitude toward the outbreak has alarmed citizens and outsiders alike. The dismissal and resignation of key political figures and investigations surrounding President Javier Bolsonaro and his family have also created political turmoil. Brazil has lost its luster, and is in danger of becoming a shadow of its former self.

Carl R. Tannenbaum is executive vice president and chief economist at Northern Trust. Ryan James Boyle is a vice president and senior economist within the Global Risk Management division of Northern Trust. Vaibhav Tandon is an associate economist within the Global Risk Management division of Northern Trust.