Over the year to the Nasdaq’s peak, the average stock went nowhere. And barely nine months after that, the index had given up all of its gains over the previous 12 months, and was lagging the average stock. Now, this is the same exercise repeated for the year running up to the Nasdaq-100’s high last month:

Tech stocks became badly overpriced and are now having a correction that probably has further to go. Meanwhile the equal-weighted S&P 500 is barely below its all-time high. At this level the Nasdaq-100, in behavioral terms, isn’t a repeat of 1999-2000.

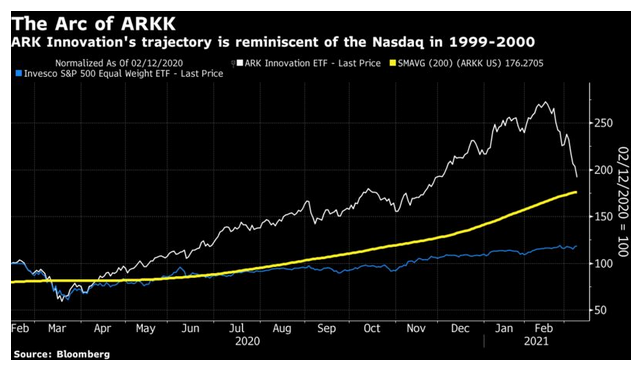

However, if we look at the most exciting stock of the moment, the Ark Innovation exchange-traded fund managed by Cathie Wood, we do see a pattern that’s distinctly reminiscent of the internet craze:

The stocks held by Ark are potential “disrupters” that are for the most part smaller than members of the Nasdaq-100 (Tesla Inc. is a big exception). Wood herself gave a great interview with Bloomberg TV in which she conceded that the market was “broadening,” which is a positive sign of recovering optimism. She also contended that the stocks faring best—such as banks, energy companies and auto manufacturers—are exactly the kind of businesses that stand to be disrupted in the long run by Ark’s investments. These are all valid arguments; buying Amazon.com Inc. in late 1999 proved to be a superlative 20-year investment, even if you had to wait a decade before you broke even. But at this point, the most exciting speculative stocks do look as though they’ve been partying like it’s 1999.

Self-Stabilizers

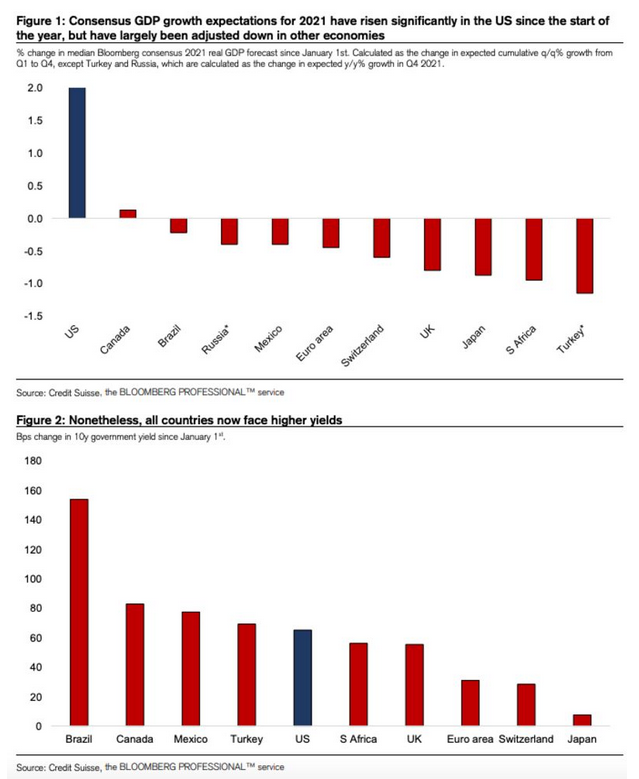

One point about market rotations is that they come with in-built stabilizers. For example, optimism on growth and fear of inflation leads to higher interest rates, which in turn dampen growth and inflation. This becomes a key question now. Estimates for U.S. growth in 2021 have risen sharply thanks to the success of its vaccine program. Forecasts for many other countries are actively declining due to vaccine disappointment. This means that yields are rising everywhere—but far faster in the U.S. than the rest of the developed world. The following charts from Credit Suisse Group AG demonstrate this nicely: