So, Dean created the “12 Tribes of Financial Planning,” to teach major differences in approach between types of firms. Dean believed people outside of financial services the financial planning “tribes” seem very similar, but they have distinct cultures and traditions. He discovered quickly that students and employers could use the framework to find better matches.

Dean found other professors and program directors having similar experiences with students, parents, recruiters or university administrators and collaborated with them to expand what he began. Earlier this year Dean was joined by those collaborators, Craig Lemoine, PhD, CFP director of financial planning program and associate professor at University of Illinois at Urbana-Champaign; Nathan Harness, Ph.D., CFP TD Ameritrade director of financial planning at Texas A&M and Martin Seay, Ph.D., CFP program chair and associate professor of personal financial planning at Kansas State University and 2019 president elect of the Financial Planning Association to present the 12 tribes construct. Formally named “Financial Service Business Models and Job Opportunities” the quartet explained the work at the CFP Board Registered Programs conference. They received a standing ovation, a rarity for panel discussions at any conference. They will present again at FPA’s national conference in Minneapolis, October 16-18.

Says Lemoine, “I found it very useful to stress the importance and range of financial planning opportunities for our students.”

Seay adds, “To me, this is one element of the "2nd generation" of financial planning programs. Programs began by slapping the CFP content onto existing programs and were not true financial planning degrees.”

I first learned of the 12 tribes on a Facebook group I belong to called FPA Activate. The four program heads have been releasing short videos on that platform to explain the concepts. FPA Activate is comprised of almost 1800 members and has become a significant member benefit for new or aspiring planners of any age and experienced practitioners like me who want to help new planners.

So, what are the business models and job opportunities available to a financial planning graduate? What skills are needed to be a good fit?

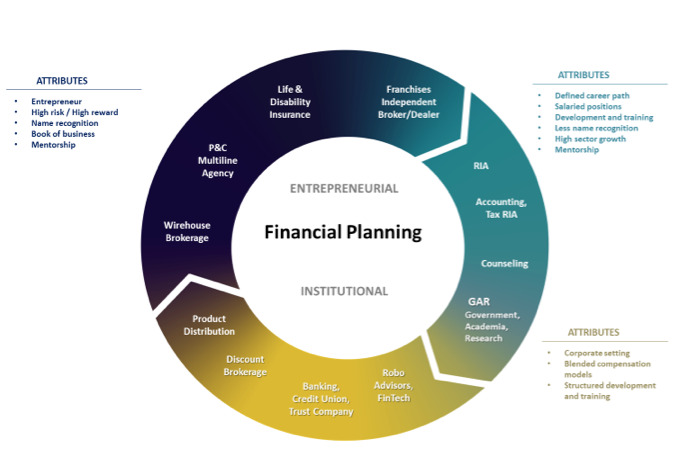

Some firms fit in multiple areas but the models in the top half are considered more entrepreneurial than those in the bottom half. “Entrepreneurial” was the word chosen to describe high risk/high reward models with good incomes for those that make it but high attrition rates. The more “institutional” models typically have lower career ceilings but often offer stability of income and strong benefits packages.

The dark blue models are typically firms with older, well-known brand names, and familiar TV ads. Most of these firms, share similarities to a wirehouse brokerage, using a “book of business” or production model requiring various sales licensing tests, a transaction-based compensation system and the standard of care of suitability or caveat emptor.

P&C affiliated planning firms tend to cater more to the middle market, adding planning to their long-running business lines. Employment opportunities are often at home offices because agents are largely not skilled in planning.