Reasons To Be Cheerful

I’ve found this a difficult newsletter to write. For much of the day, it was hard to think of anything other than the astonishing goings-on in British politics. Then, as I was finishing it, came the shocking news of the shooting of former Japanese Prime Minister Shinzo Abe.

Matters of profit and loss pale in comparison with matters of life and death.

Markets continue to churn. In a few hours as I write, the publication of US non-farm payroll data for June will give people all kinds of excuses to buy and sell things. The central question confronting the world of investment continues to be the state of the US economy, and the impact the employment market has on inflation; at this point, there isn’t long to wait.

While we anticipate some important data, and try to deal with the gravity of events, it’s easy to miss good news. So, let me offer a few reasons for optimism that it has been easy to overlook.

China’s Stimulus

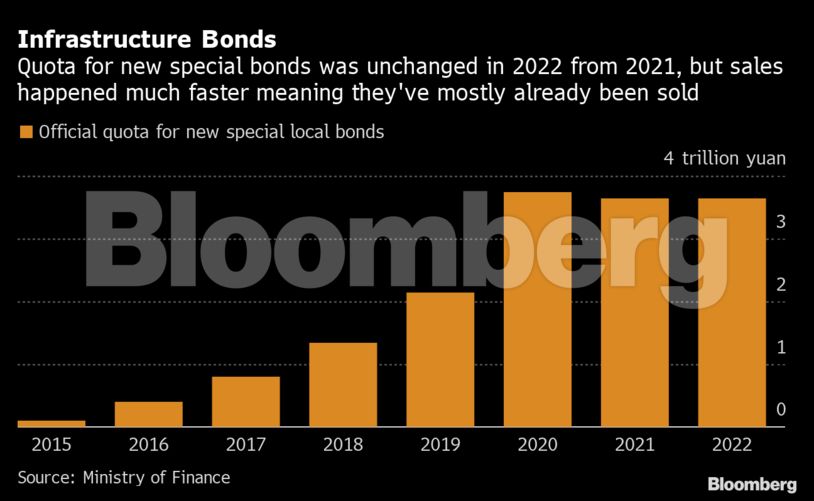

Bloomberg has a scoop that China is contemplating a direct stimulus to its economy by bringing forward $220 billion in bonds issuance to back infrastructure. You could take this as tacit confirmation that the economy is in trouble. It’s a return to the old strategy of pumping up construction spending whenever growth is running out of steam. And it’s only a matter of bringing forward spending that had already been planned; the idea is that local governments building projects can now access financing that would not otherwise have been available to them until next year.

However, the plan also shows that the authorities are prepared to relent in the face of signs that local governments are using the financing that’s there. If they’re prepared to go back to an old playbook that worked, that’s fine by global investors. This graphic from my colleagues illustrates what is going on:

Plenty of bearish arguments hinge on the notion that Chinese authorities are resolved not to resort to a major priming of the pump. Any sign that they are growing less conservative is welcome. There are other unmistakable signs that China’s economic deceleration after renewed Covid shutdowns early this year hasn’t been as bad as feared. Its domestic stock market is surging back, even as the rest of the emerging world is falling back.

There are reasons for this. The strong dollar is seriously problematic for the rest of EM, but less so for China. The country’s entire experience of the pandemic is out of alignment with the rest of the world. The acute selloff for the commodities that China traditionally gobbles up, such as copper, shows the degree of concern. So if the Chinese government really is prepared to pick up the pace again, that will help far beyond its shores. It’s at least worth watching.

Supply Chains

Inflation owes a lot, if not everything, to stretched supply chains. This problem is beyond the reach of central banks, but still threatens to make the task of monetary policy far harder by embedding inflationary pressure and prompting higher wage demands.

On this issue, there is again some good news. The New York Fed now keeps an index of global supply chain pressure, which smooshes together shipping and freight costs and other measures of how swiftly supply chains are moving. Theserose sharply in 2020, declined, and then surged once more as fresh Covid-19 lockdowns affected activity, particularly in China.