You know it’s a bad year for U.S. equities when a large-cap fund was up one-half of a percentage point through early November and your first thought is something like, “Wow, that’s great!” But so it goes in a year when that fund’s bogey, the S&P 500, was down 20% during that period.

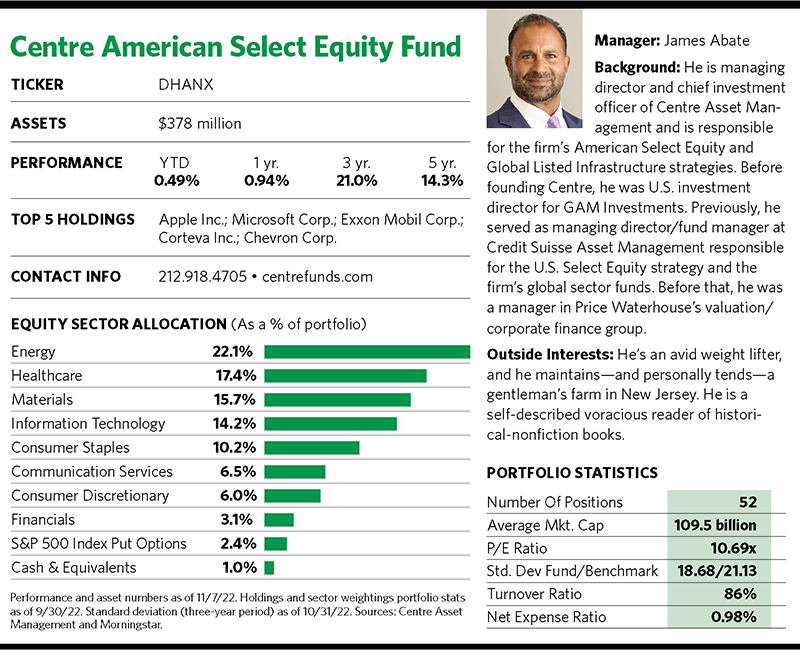

The fund in question is the Centre American Select Equity Fund, one of just two U.S.-listed mutual funds offered by Centre Asset Management LLC, a small investment shop in New York City. The company was founded in 2006 by James Abate, who serves as the portfolio manager of the American Select Equity Fund. (He also oversees the much smaller Centre Global Listed Infrastructure Strategies Fund.)

The American Select Equity Fund has garnered nearly $380 million in assets and racked up enviable performance numbers that made it the top-performing fund in Morningstar’s large-blend category during the one-, three- and five-year periods, and also for the year to date through November 7.

That doesn’t mean the fund always hits the mark. For example, it was in the bottom quartile among its category peers in 2019. But long-term holders of this fund have benefited from Abate’s bottom up-driven economic value added philosophy, or EVA, which looks at corporate capital allocations and seeks to identify rates of return on those allocations that exceed or fall short of costs of capital.

Or as Centre describes it, EVA is an investment approach focused on finding creators of shareholder value and avoiding value destroyers.

The fund comprises a high-conviction portfolio of roughly 50 stocks, and is positioned as a core growth fund with an emphasis on risk management and downside protection.

“It’s not only about stock selection, but it’s also about having a strong awareness about risk, particularly downside volatility,” Abate says. “We think of ourselves as the mutual fund that every hedge fund wishes they were.”

The fund employs hedges to help mitigate downside risk, which Abate says enables it to match the upside capture performance of its category while providing significantly more downside protection. According to Morningstar, the fund had slightly exceeded its category’s upside capture ratio during the recent three-year period and slightly trailed in the five-year period. Meanwhile, it provided massively better downside protection against the category as a whole during both time frames, with downside capture ratios that were 40 basis points less than the category during the three-year period and 30 basis points less during the five-year period.

Underlying Strategy

Abate attributes the fund’s success to the EVA strategy, as well as the position sizing within the portfolio and his ability to tactically use hedges.

“It’s an integrated approach, but first and foremost is the securities selection methodology,” he explains, adding that he has pounded the table about EVA for years through papers and books he has written on the strategy.

Abate posits that the vast majority of analysts still myopically focus on basic variables such as P/E multiples and earnings per share momentum. He doesn’t ignore these metrics, but instead incorporates them into a holistic approach that includes other fundamental drivers. “I come from a corporate finance and valuation background, so we take a long-term corporate financier’s view of every single business we invest in.”