Drugmaker Amarin Corp Plc shocked the world last year when a long-running clinical trial showed that its medicine derived from purified fish oil, Vascepa, substantially reduced the risk of cardiovascular events like heart attacks in high-risk patients. After the euphoria and 300% stock rally off the news faded, the question remained precisely how big a blockbuster it might be.

Part of that question was answered Thursday after a panel of experts convened by the Food and Drug Administration reviewed Amarin's data. They voted 16 to 0 that Vascepa was safe and cuts cardiovascular events. The vote doesn’t bind the FDA, but the agency often follows panel recommendations, so it would be a surprise now if the drug isn’t made available to more Americans. That’s big news for Amarin—and for many patients.

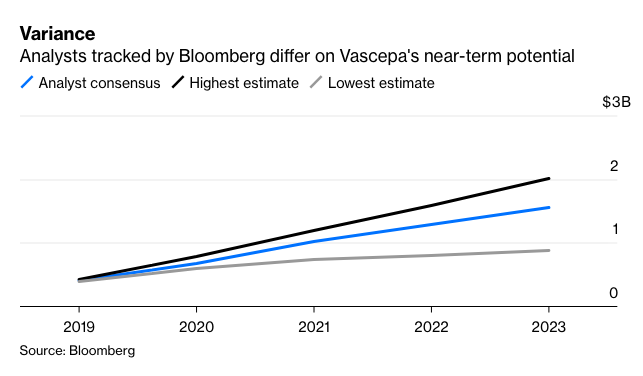

We still don't know exactly how good the news is, however, and won’t until the FDA makes a final decision by the end of the year. There was consensus on the drug’s overall effectiveness. Still, the panelists disagreed about how far that impact extends. Access for millions of additional patients and billions of potential sales are still up the air, which means there’s more volatility ahead for Amarin investors. The market seems focused on the positives for now: Amarin shares surged 7% in early trading Friday after rising more than 20% on Tuesday, when the FDA released briefing documents ahead of the panel that were seen as relatively supportive for the drug.

Vascepa is already available for a small group of people with very high triglycerides, a blood fat that the drug targets. Now Amarin is understandably looking to leverage its dramatic success into the biggest possible new commercial opportunity.

But while Vascepa’s benefit looks clear in patients that have already had a cardiac event—hence the unanimous vote—some panelists weren’t as convinced on its impact on lower-risk patients, the largest potential market for the drug. In their view, because the benefits aren’t as strong in that group, questions about the drug’s impact and safety should carry more weight and limit the scope of approval. Those concerns included the use of mineral oil in the placebo arm of the trial, which may have mildly impacted trial results, as well as a potentially elevated risk of bleeding and atrial fibrillation.

The number of potential nuances in the drug’s expanded approval and the size of the population in question mean that the specifics of the agency’s decision will still be a huge swing factor for Amarin. The FDA’s choices will go a long way towards determining Vascepa’s upside, growth trajectory and whether an expensive additional trial may crimp Amarin’s profitability.

The skeptics weren’t the only voices in the room. A number of panelists focused instead on the overall positive impact shown in the trial and were more comfortable with broader prescribing guidelines. Advocates who spoke during the public portion of the meeting, as well as at least one panelist, noted that a restrictive approval would likely lead insurers to more strictly curb the use of a medicine that could benefit many people.

The FDA holds these panels for a reason and will consider the concerns raised on Thursday. But it will also look at the risks of being too cautious, given the enormous economic and personal burden created by cardiovascular disease. After all, it isn’t often that we see a medicine that can impact America’s biggest cause of death in a cost-effective way.

This article was provided by Bloomberg News.