Steve Romick likes to use colorful metaphors to describe his investment process at the FPA Crescent Fund, which he has run since its inception 30 years ago. This go-anywhere fund invests across capital structures, geographies, sectors and market caps while targeting equities and fixed income along with a dollop of unconventional asset types.

“We are free-range chickens,” says Romick, who since 2013 has shared portfolio manager duties with Mark Landecker and Brian Selmo.

But the fund’s mulligan stew approach makes it hard to categorize. Morningstar, for example, puts it into its amorphously labeled “moderately aggressive allocation” category. The fund’s managers compare the portfolio’s performance against four different benchmarks—the MSCI ACWI (which stands for All Country World Index) and the S&P 500 for equities, and separate (but hypothetical) 60/40 bogeys with the 60% equity portion being either the ACWI or the S&P 500 and the 40% fixed-income portion tracking the Bloomberg U.S. Aggregate index.

“How do you benchmark a fund whose stated goal is to provide equity-like returns while avoiding permanent loss of capital?” Romick asks rhetorically. “We have lots of tools at our disposal beyond common stocks, such as preferred stocks, junior and senior debt, bank debt, convertible notes. We use some derivative notes periodically. We do some shorting.

“We look at the MSCI ACWI as the most traditional benchmark to compare us to since we became more global starting in 2011, but I think it’s also reasonable to look at a CPI-plus benchmark as well,” he continues, referring to the Consumer Price Index, plus a subjective equity risk premium added by the firm.

No matter the benchmark, Romick views his fund as the furthest thing from a closet index. “We just do what we do.”

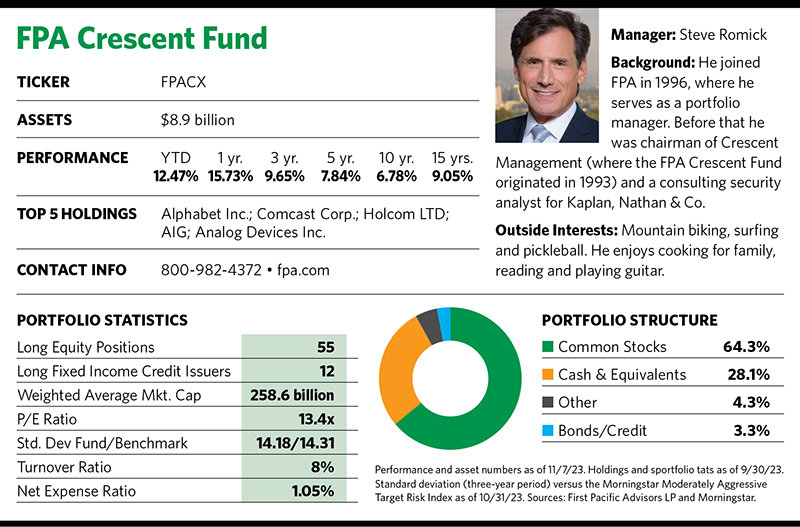

And what he and his team have done is provide positive returns, making their fund one of the top performers in its Morningstar category during the past 15 years, particularly during the past five years. More important, Romick says, the FPA Crescent Fund’s value-oriented approach has made money over every rolling five-year period during the past 30 years.

Base Case

Value investing is a core element at Los Angeles-based institutional money manager First Pacific Advisors LP—the “FPA” on the fund’s nameplate.

In a report from earlier this year, Morningstar analyst Chris Tate described the FPA Crescent Fund’s crew as absolute value investors who view risk as the possibility of suffering permanent loss, not underperforming a benchmark or peer group. He further stated that they favor securities trading at discounts to their estimated worth, names that can deliver high-single-digit or double-digit returns. The team is not afraid to load up on cash if it doesn’t find suitable opportunities.

“A lot of value managers forget about the upside and focus on the downside,” Romick says. “We think about upside in the context of the downside. We’re here to make money for people over time, but we don’t want to blow them up.”

That’s reflected in the fund’s risk/reward profile. According to Morningstar, the fund has a higher upside capture ratio and a lower downside capture ratio than its category.

Stocks typically represent the fund’s largest asset class allocation, and Morningstar notes that the valuations of the fund’s equities—in terms of price-to-earnings/book/sales/cash flow—are lower than the category’s average. Romick says that’s simply a byproduct of what the fund does and not a targeted goal.

“The thought process [on valuation] is to always seek a margin of safety in the investments we make. Look before you leap.”

Romick and his team use equity valuations mainly as a way to seek protection, so they’ll pay a reasonable price for growing, sustainable businesses with good management teams that use capital wisely and produce substantial cash flow.