That includes real estate casino and gaming companies, vacation time-share companies and amusement park operators. But Kolitch is selective. He trimmed fund positions in real estate casino and gaming companies such as Wynn Resorts Ltd. and Las Vegas Sands Corp. in the second quarter, mainly because of the ongoing pandemic-related travel restrictions in China, Macau and Singapore. He notes that he might buy additional shares of these companies in the future as travel restrictions lift and business activity resumes.

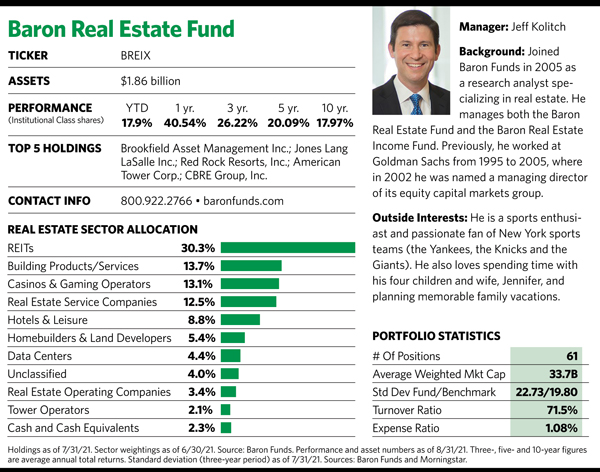

The pandemic recovery theme also focuses on commercial real estate services companies (such as CBRE Group Inc. and Jones Lang LaSalle Inc.) and land development companies (including the Howard Hughes Corp.). The theme further encompasses certain REITs in the office, apartment, mall and shopping center sectors, among others.

One of the Baron Real Estate Fund’s top net purchases in the second quarter was Vornado Realty Trust, a REIT that owns what Kolitch calls a high-quality portfolio of office and retail assets concentrated in New York City. He thinks leasing and occupancy trends will improve in the city as the economy rebounds, and he offered that Vornado’s stock price is attractively priced vis-à-vis his estimate of the company’s net asset value.

The second major theme pertains to residential real estate. Kolitch says there has been a structural underinvestment in residential construction, which he thinks will likely reverse in coming years.

“Most people think about multifamily rental when they think of residential REITs, but we look at the for-sale market that includes [home builders] Lennar, D.R. Horton and Toll Brothers. And we look at residential real estate-related building products companies such as Lowe’s, where there’s a very close correlation between what their business is doing and what’s happening in the housing market.”

The third investment theme relates to the intersection of technology and real estate. That includes real estate data analytics companies (for example, Zillow Group Inc.), as well as real estate tied to data centers and wireless tower operators.

“We own American Tower, a well-known tower REIT, but we also own a non-REIT tower company in Europe called Cellnex,” Kolitch explains. “This company trades at a similar multiple valuation to REITs, but will grow its cash flow over the next three to five years [at a pace that’s] at least twice the growth rate of many of the tower REITs.”