Despite recent predictions by ECB watchers and the euro’s huge move up against the dollar on Friday, Anatole Kaletsky at Gavekal thinks Draghi is still far from reversing course. He expects that the first tightening steps won’t happen until 2018 and anticipates continued bond buying (at a slower pace) and near-zero rates for a long time after. But he also sees risk. Anatole explained in a recent report:

Firstly, Fed tapering occurred at a time when Europe and Japan were gearing up to expand monetary stimulus. But when the ECB tapers there won’t be another major central bank preparing a massive balance sheet expansion. It could still turn out, therefore, that the post-crisis recovery in economic activity and the appreciation of asset values was dependent on ever-larger doses of global monetary stimulus. If so, the prophets of doom were only wrong in that they overstated the importance of the Fed’s balance sheet, compared with the balance sheets of the ECB and Bank of Japan.

This is a genuine risk, and an analytical prediction about the future on which reasonable people can differ, unlike the factual observations above regarding the revealed behavior of the ECB, the Franco-German rapprochement and the historical experience of Fed tapering.

Secondly, it is likely that the euro will rise further against the US dollar if the ECB begins to taper and exits negative interest rates. A stronger euro will at some point become an obstacle to further gains in European equity indexes, which are dominated by export stocks.

Anatole makes an important point. The US’s tapering and now tightening coincided with the ECB’s and BOJ’s both opening their spigots. That meant worldwide liquidity was still ample. I don’t see the Fed returning that favor. Draghi and later Kuroda will have to normalize without a Fed backstop – and that may not work so well.

Black Swan #3: Chinese Debt Meltdown

China is by all appearances unstoppable. GDP growth has slowed down to 6.9%, according to official numbers. The numbers are likely inflated, but the boom is still underway. Reasonable estimates from knowledgeable observers still have China growing at 4–5%, which, given China’s size, is rather remarkable. The problem lies in the debt fueling the growth.

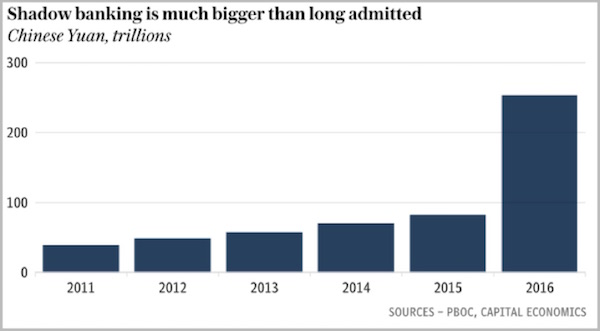

Ambrose Evans-Pritchard reported some shocking numbers in his July 17 Telegraph column. A report from the People’s Bank of China showed off-balance-sheet lending far higher than previously thought and accelerating quickly. (Interestingly, the Chinese have made all of this quite public. And President Xi has taken control of publicizing it.)

The huge increase last year probably reflects efforts to jump-start growth following the 2015 downturn. Banks poured fuel on the fire, because letting it go out would have been even worse. But they can’t stoke that blaze indefinitely.

President Xi Jinping has been trying to dial back credit growth in the state-owned banks for some time; but in the shadow banks that Xi doesn’t control, credit is growing at an astoundingly high rate, far offsetting any minor cutbacks that Xi has made.

Here are a few more juicy quotes from Ambrose:

President Xi Jinping called for a hard-headed campaign to curb systemic risk and to flush out “zombie companies”, warning over the weekend that financial stability was a matter of urgent national security.