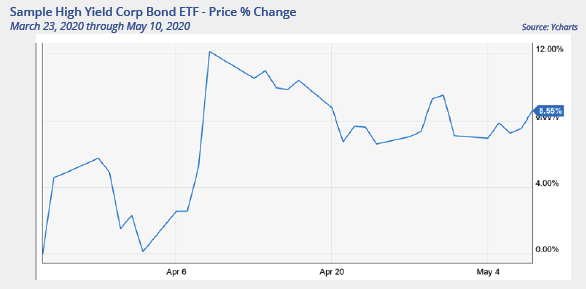

Taking our prior example through to the time of writing, the chart below shows the tactical manager’s re- purchase date through May 10. The gain during this new holding period is a vigorous 8.6%.

While the tactical manager seeks to avoid sickening losses, it is also important to that after periods of weakness, recovery and uptrends begin. Thus, the second reason to use tactical investment management to participate in those gains.

Why Tactical? Reason #3: Seeks Better Return, Less Risk

Just take a look at the health records. The tactical manager earned 7%, stepped out of the way during the drawdown that began in late February, and then earned an additional 8.6% when returning in late March. That total return of more than 16% over the holding periods stands in stark contrast to the buy and hold passive manager who lost -1.7% over more than 16 months. A line in the sand sell combined with a disciplined buy rule results in better returns and less drawdown.

Why Tactical?

We began this piece with a question: how can investors avoid that sickening period that can mean losing a third of their wealth and also participate in price recovery? We believe the answer comes from applying tactical investment management. Tactical strategies seek to manage losses, participate in gains and therefore create better returns with less risk than passive approaches can.

When you can make more money with less risk, just do it.

Terri Spath, CFA, CFP, is chief investment officer and portfolio manager at Sierra Investment Management.

Just as a healthy patient can emerge from illness better than a feeble one can, a tactical investment approach may create stronger returns with less risk than a passive “buy and hold” approach can.