Newer corporate bonds and loans have fewer stringent covenants than they did in the past. That reduces the protections for investors, says Robert Kaplan, president of the Dallas Federal Reserve. “In a downturn, some proportion of ‘BBB’ bonds may be at risk of being downgraded to less than investment grade,” he noted in a March report. “These downgrades, if they happen in sufficient size, could create dislocations for investors who tend to have specific allocations or restrictions based on credit-rating categories. These dislocations could further negatively impact credit spreads and market access for more highly indebted companies.”

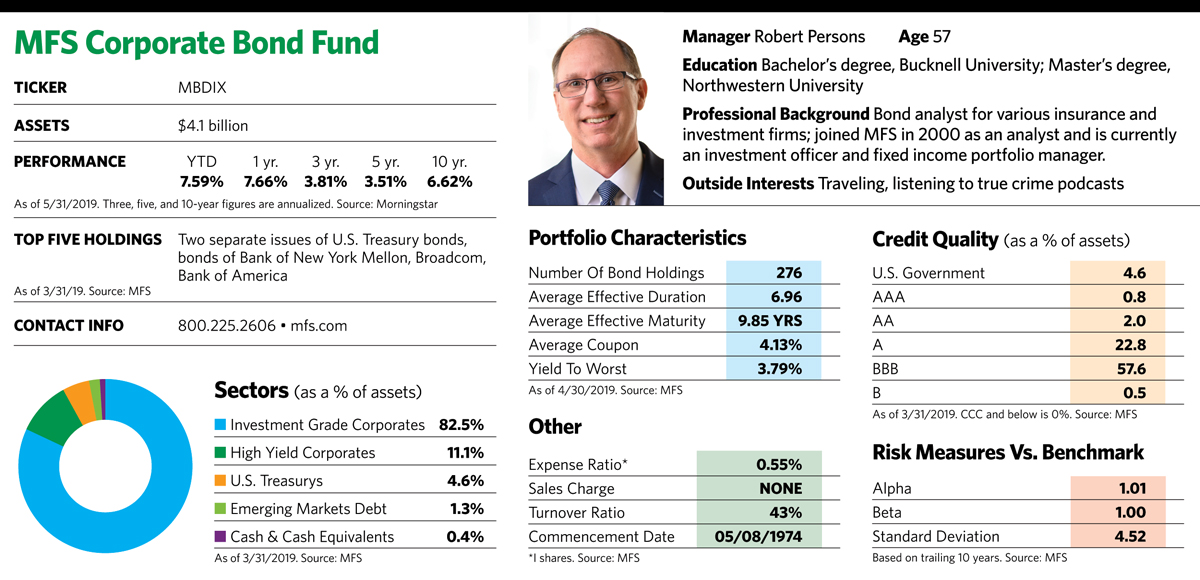

Persons acknowledges that corporate debt is at an extraordinarily high level, especially for a period of economic expansion. But he believes the problem isn’t a systemic one, as it was in 2008. Many of the companies that have issued bonds since the financial crisis are in more defensive industries, such as technology. “In 2008, companies such as Microsoft, Intel and Apple had no debt. Now, they are big issuers in the market. No one seems worried about Apple’s ability to service its debt if a downturn occurs.”

The increase in debt is also spread out in a broader range of industries and companies than it was years ago. “A lot of different kinds of companies have taken on a little more debt,” Persons says. “That’s different than it was in 2008, when enormous leverage in the banking system froze the economy.” He adds that pension funds, insurance companies and other institutional investors with a mandate to invest in investment-grade securities support demand in the “BBB” market.

Still, some companies will be better prepared than others to weather an economic downturn. “That’s why investors need to be more vigilant than ever, which argues for active over passive investing,” says Persons.

To Catch a Rising Star

July 1, 2019

« Previous Article

| Next Article »

Login in order to post a comment