Given the flow of investor money into exchange-traded funds, it’s clear they’ve become very popular. ETFs trade throughout the day, like stocks, yet there are some key differences to keep in mind.

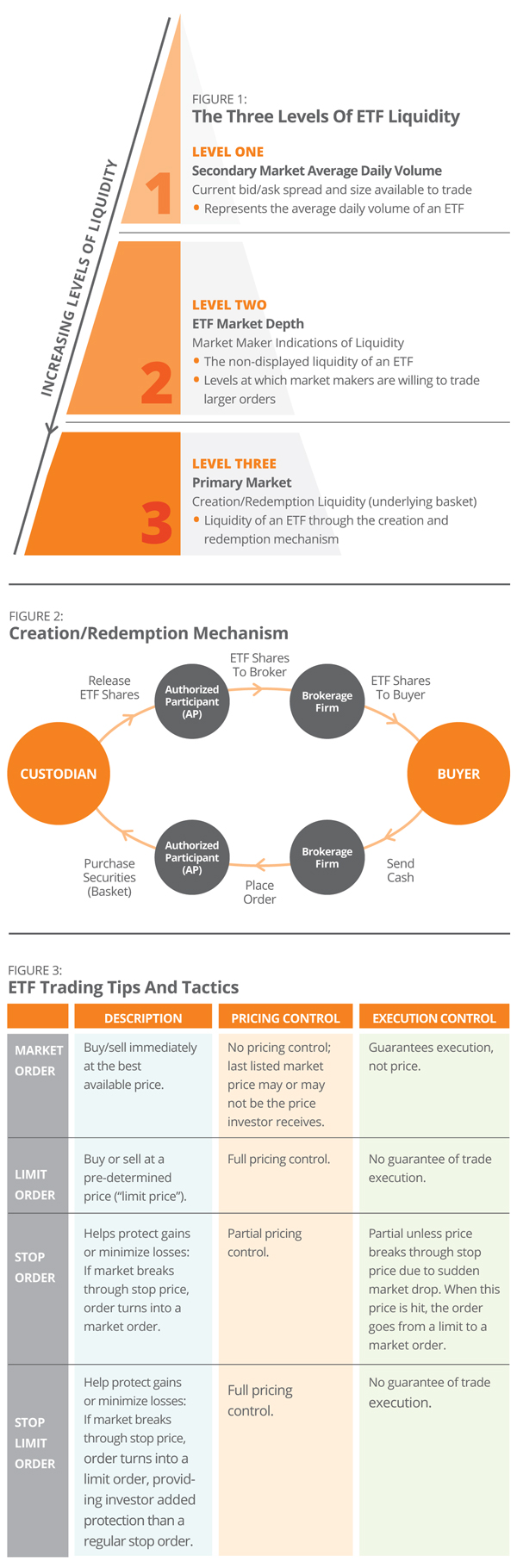

In the world of stocks, trading volume has always been a strong indicator of liquidity, or the degree to which stocks can be bought or sold in the market without affecting their price. However, when looking at ETFs, volume is only a reflection of what has traded—not what could have traded. ETF liquidity is easy to understand once you comprehend the three levels of liquidity for an ETF that may come into play when executing a trade.

Level One: Secondary Markets

The simplest way for an ETF to trade is for a buyer and seller to be matched on the secondary market. For this to happen, a market maker publishes quotes that represent the price and number of ETF shares it is willing to buy and sell. The best of the quotes is known as the National Best Bid and Offer (NBBO) quotation. The difference in the bid and offer (also known as ask), is the spread. The spread is the payment the market maker receives for matching the buyer and seller of the ETF.

Differences in the bid-ask spreads among ETFs can have a meaningful impact on both trading cost and total return, so investors will want to take them into consideration when making investment decisions.

Level Two: Market Depth

The size and prices that are displayed through the NBBO are not the only quotes an investor can use. For most ETFs, market makers will publish quotes beyond the NBBO, helping to provide market depth. Market makers do this so that larger trades can be executed while covering the costs of providing the liquidity. There are a few ways to access this liquidity. One is to use a limit order to direct your broker to buy or sell ETF shares at a price beyond the NBBO, breaking up a trade into smaller trades, or contacting a broker-dealer’s ETF block desk, which handles large purchases and sales of ETF shares.

Level Three: Primary Markets

The heart of ETF liquidity is the primary market. This is where the “creation and redemption mechanism” comes in. The volume of the underlying securities is a source of liquidity for the ETF.